Be Careful When Buying Beaten-Down Office Stocks

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- April 10, 2023

Buying into beaten-down stocks or sectors can work in your favor… under the right circumstances.

In recent weeks, I’ve written about battered bank stocks, including one that just made what I believe is the banking deal of the decade.

But now there’s another sector that’s getting panned: commercial real estate. Specifically, office real estate, as US office occupancy rates are between 40% and 60% of their pre-COVID levels (according to real estate firm JLL).

People are predicting the death of the office, and as a value investor, I can’t help but look at the sector to see if sentiment has become too one-sided.

After all, we had success with Vistra Corp. (VST) after Winter Storm Uri cost the Texas utility a few billion dollars in 2021. We also did well on Starbucks Corp. (SBUX) after an unexpected change in management last year jump-started its ailing share price.

Still, although we’ve had success buying beaten-down stocks, it doesn’t mean it’s a foolproof strategy. You can’t just throw darts at a board when a sector falls.

The right investment requires checking off every box before you pull the trigger.

Are Offices Really Dead?

COVID changed everything when employees were forced to work from home.

While some companies have pushed for a return to the office, others have adapted to the change and are allowing their workers to stay remote. That’s a bad sign for office owners.

-

As leases come up for renewal, many companies that have embraced “work from home” as the new normal will opt to terminate.

It’s a different story in Europe and Asia, as occupancy rates have returned (or even exceeded) pre-COVID levels. Will the US “catch up” to the rest of the world? If so, office cash flows should be fine.

However, there’s another huge issue to consider…

-

What are office assets worth in a higher interest rate world?

Commercial real estate is a levered asset class. That means properties almost always have mortgages on them. When those mortgages mature and asset owners have to refinance, the interest cost could double or more.

That impacts the cash flow and, most important, reduces the amount of cash that can be paid to shareholders in the form of dividends.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

In the zero-interest-rate world, office properties were purchased at 6% cap rates. (A building purchased for $1 million that generates $60,000 in income before debt service is said to trade at a 6% cap rate.)

Well, rates are no longer zero. And higher interest rates—coupled with work from home—have me concerned about buying traditional office real estate investment trusts (REITs).

Why buy a risky asset like an office at a 6% yield when you can get 4%–5% with much less risk?

Then There’s the Gravedancer

In 2021, I told Smart Money Monday readers about Sam Zell’s special situation real estate company, Equity Commonwealth (EQC).

Sam Zell is a billionaire real estate investor known for seeing value where others don’t. He’s made a lot of money capitalizing on this opportunity.

Equity Commonwealth is an office REIT… sort of. It has been an active seller of office real estate since Zell took control of the company in 2014.

Today, EQC owns four office properties, all of which are being marketed for sale. It also holds $2.5 billion in cash.

Adjusted for a recently announced special dividend, that cash balance comes out to about $2.03 billion. On a per share basis, that’s $18.53 per share. Compare that to the current $20 stock price.

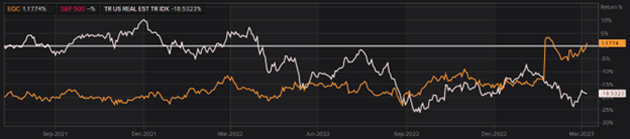

EQC has done well relative to the broader real estate sector since I first recommended it (up slightly versus the Refinitiv US Real Estate Total Return Index’s -18.5% return):

Source: Thomson Reuters Eikon

If any company is going to take advantage of distress in commercial real estate—be it office or otherwise—it will be EQC.

So, if you’re looking for low-risk exposure to commercial real estate, Equity Commonwealth (EQC) offers a better risk/reward setup today compared to other REITs.

But Keep an Eye on VNO

There’s one name I have on my radar, which I’ve been following for more than five years: New York office REIT behemoth Vornado Realty Trust (VNO).

Vornado is run by Chairman and CEO Steven Roth, a legend in the real estate world. He’s still working at the company, even at 80 years old. He clearly loves the game.

Roth owns approximately 5% of Vornado, worth around $150 million today. Just a few years ago, Roth’s stake was worth over $700 million. So, he’s obviously hurting right now.

Vornado checks a lot of boxes for me. The main one is the talented owner/operator at the helm with significant skin in the game.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

The market cap of the company is around $3 billion. Sitting above that equity, though, is $13 billion in debt and preferred stock.

Fortunately for Vornado, 70% of its debt is at low fixed interest rates of around 3.6%. The rest of it floats, which is a risk.

Current occupancy at Vornado is 90%, which is a strong figure. However, what matters is lease renewals and new renewal rates. With a ton of office supply out there, tenants have a lot more leverage with landlords than they had in the past.

The debt, plus the re-leasing risk, makes Vornado a “pass” for me… for now. Stay tuned, though, because that could change if everything comes together.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

P.S. We’re just three weeks out from the beginning of the 2023 Strategic Investment Conference (SIC). So, mark your calendar because five full days of high-level presentations, expert panels, and fireside chats from dozens of expert speakers await. If you haven’t already, you can order your SIC 2023 Virtual Pass today and learn more about what challenges and opportunities may lie ahead.

Tags

Suggested Reading...

|

|

Thompson Clark

Thompson Clark