What History Tells Us About Buying in a Recession

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- December 12, 2022

There’s a lot of chatter out there about recession…

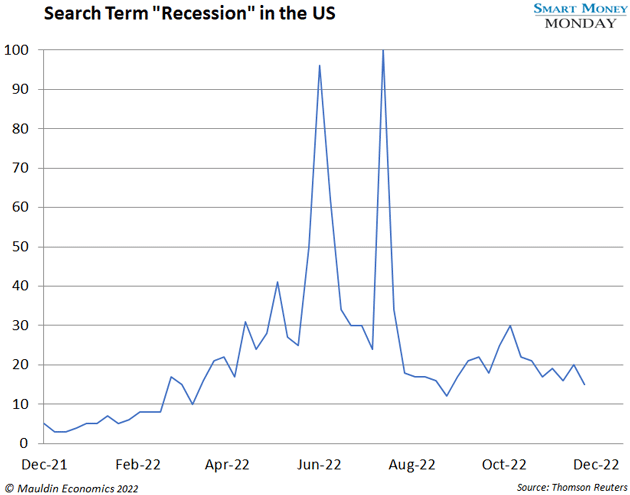

As you can see below, search data for “Are we in a recession?” is up big this year—on July 24, search interest spiked to 100, or the value used to represent peak popularity.

Clearly, recession is on a lot of people’s minds.

So, what does this mean for stocks? Well, the thought process often goes: “If we’re in a recession, I’m definitely not buying!”

But this approach is ill-advised. When we’re in a recession—officially—avoiding stocks is exactly the wrong thing to do.

-

Rather, a recession indicates that it’s time to buy, not sell.

Just look at the data…

A Lagging Indication

We’ve had three official recessions in the past 20 years, according to the National Bureau of Economic Research, or NBER:

-

The first was the dot-com boom and bust. This recession started in March 2001 and ended in November 2001.

-

The second was the global financial crisis. It started in December 2007 and ended in June 2009.

-

The third and most recent was the COVID crash. That brief recession lasted from February 2020 until April 2020.

The problem with this neat-and-tidy label of beginning and end is that it’s backward-looking.

|

This one overlooked area of your portfolio could help you |

The NBER didn’t tell us in December 2007 that we were in a recession. Same is true for both the dot-com bust and COVID crash.

Instead, the NBER told us well after the fact.

The Official Announcement

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

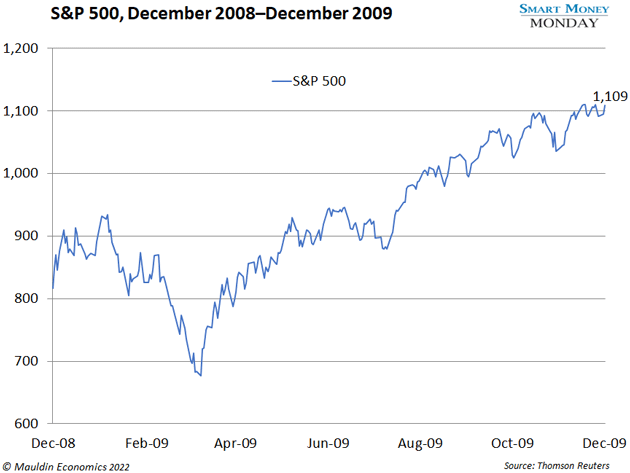

Looking specifically at the global financial crisis, the NBER told us in December 2008 that December 2007 was the peak in economic activity.

So, a full year later, it identified that the US was in a recession.

Surely markets crashed immediately upon the announcement, right?

Nope. Exactly the opposite...

In December 2008, the S&P 500 was at 816. A year later, it rose 36% to 1,109.

Similar stories played out for the 2001 and 2020 recessions.

So, it begs the question…

How Should We Position Ourselves Now?

The NBER hasn’t formally announced a peak in economic activity, but it may soon.

One of its criteria is two consecutive quarters of negative GDP growth. So far this year, we’ve had that.

However, that’s not the NBER’s only criteria. There are other factors that play into its decision to formally announce it.

Regardless, I think it’s all distractive noise.

The recession discussion leads me to the same advice I constantly repeat in Smart Money Monday.

-

That is, find and invest in stocks that are cheap with strong insider alignment and good growth prospects.

Plenty of stocks are on sale. That’s certainly the case with the pond I fish in, the S&P 600, which is a basket of profitable small-cap companies.

Right now, the S&P 600 trades for just 13.7 times next year’s earnings per share. That’s an extremely cheap valuation.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Inverting that number on the S&P 600, 13.7 times earnings pencils out to a 7.3% earnings yield.

Sure, short-dated two-year US government bonds currently yield 4.3%. That’s government-guaranteed money.

But here’s the catch: Would you take a guaranteed 4.3% versus 7.3% in stocks? I wouldn’t. The government bond yield never grows. And it only “lasts” for two years.

Companies, and especially those in the S&P 600, have embedded growth. They have good futures with strong upside.

The concerns around recession just aren’t that important to me. If anything, the formal declaration of a recession means stocks are closer to a bottom than a top.

So, formal announcement or not, I’m sticking to my knitting: buying quality companies with insider alignment and good future growth prospects.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Tags

Suggested Reading...

|

|

Thompson Clark

Thompson Clark