Beijing’s Dilemmas

-

John Mauldin

John Mauldin

- |

- January 21, 2022

- |

- Comments

- |

- View PDF

Ranked by population, the United States is the world’s third largest country, behind China and India. But the gap is greater than the ranking implies. According to Worldometer, as of 2020 China had 1.44 billion people, India 1.38 billion, and the US 331 million.

In other words, by population China is more than four times larger than the US. So is India. Together they represent about 36% of humanity, the US only about 4%. We aren’t in the same league, population-wise.

By standard of living, military power, and many other measures, the US is in a league of its own, too. Our economy is far bigger. Nevertheless, sheer size makes China and India impossible to ignore. And of those two, China has more economic influence for now.

Many analysts project China will soon be larger by GDP than the US—which shouldn’t be so hard with a population four times larger—but it’s not clear to me that China’s seemingly unlimited linear growth will continue three or four more decades. I can remember when the same was said about Japan.

Today we’ll talk about Beijing’s dilemmas and the choices Xi Jinping is making. As you will see, they matter to everyone, everywhere.

Perfect Storm

Two weeks ago I mentioned the Chinese city of Xian was in lockdown due to Omicron cases. That wasn’t quite right; they were still facing the Delta variant at the time. But Omicron is definitely there now. Cases are popping up all over China.

At the rate this new variant spreads, it is not clear the quick, ruthless response China has employed thus far will keep working, but the government appears intent on trying. It’s affecting both international and domestic travel. Here’s a note I received from John Browning, a longtime Shanghai resident.

“Here in Shanghai ex-pat chat groups remain focused on understanding the latest travel restrictions. In addition to the COVID testing done prior to departure, one Shanghai resident explained he had left Tianjin on the 1st January for his home in Shanghai. On the 9th Tianjin was declared a high-risk location. At 1:30 am in the morning on the 10th of January he received a phone call from the medical authorities in Shanghai and later that day he was moved into a Shanghai quarantine hotel. He remained in medical quarantine for 5 days until Saturday the 15th when he returned to his family.

“So, the risks are, should I travel outside of Shanghai to another province and while I’m there it turns high risk, I will have to go into strict lockdown in that location and be unable to return to Shanghai for 2 weeks. But also, should I go outside Shanghai and return safely, in the two weeks following my return, should the location that I visited subsequently become high risk then I will have to go into strict lockdown for a balance period as in the example above.

“Therefore, my current appetite for leaving Shanghai to travel internally is of course zero. The millions that usually travel home for the Lunar New Year festival at the start of February will remain where they are. And there will be no hiking along the more remote and wilder parts of the Great Wall for me this spring.”

Unlike some Western countries, reports indicate most Chinese people support tight restrictions. They have been told the government is keeping them safe from a deadly virus and, to date, it appears to have done so. Other than the active containment zones, life in China is reportedly quite normal.

The costs are less visible but still significant: slower growth, fewer investment and business opportunities, higher consumer prices. Those would be challenges in any case, but China already had problems before COVID added to them. Ian Bremmer described the dilemma.

“The [Chinese] government has three policy priorities but can at most only accomplish two:

-

maintain a zero COVID policy;

-

keep economic growth around 5%;

-

pursue long-term goals that subtract from near-term growth, in particular ‘deleveraging’ policies to stabilize debt levels as well as environmental/climate measures.”

At least one of those goals has to come off the table for 2022. Ian thinks it will be the third one. Economically, that may please some Western investors who want more leverage in the global system and see China as a good place to get it. This becomes even more important with the Federal Reserve headed toward tighter policy. Simultaneous deleveraging in both of the world’s two largest economies might have been difficult. But now, with the PBOC cutting rates and being otherwise accommodative, they can avoid that fate.

But Xi is concerned about the Federal Reserve raising rates. He spoke virtually to the annual Davos conference this week. This is from MarketWatch via my friend Mark Grant:

“Chinese President Xi Jinping took to the virtual Davos stage to address Fed Chairman Jerome Powell with this message: Please don’t lift interest rates.

‘If major economies slam on the brakes or take a U-turn in their monetary policies, there would be serious negative spillovers. They would present challenges to global economic and financial stability, and developing countries would bear the brunt of it,’ said Xi, according to a transcript of his remarks on Monday.”

The Fed normally comments that they can only set policy for the US. But that doesn’t mean that Xi isn’t right. It will have an impact on emerging economies.

Another year of zero COVID could get uncomfortable for China. It seems not to have a Plan B if Omicron gets out of hand, which seems quite possible. The population has little natural immunity because it’s had so few infections. Some studies show Chinese vaccines, which are not as effective as Moderna and Pfizer/BioNTech in the first place, offer even less protection against Omicron. This means already-harsh containment measures may have to get harsher.

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In some ways this hearkens back to the pandemic’s earliest days, when vigorous lockdowns affected Chinese factory production and exports. The government will no doubt take extraordinary measures to keep goods flowing. If they don’t work, it will be a problem for everyone.

But China has some other unique long-term problems that are even harder to fix.

Shrinking Population

The pandemic has depressed birth rates in many countries. It’s easy to see why, too. Cooping up families at home together, often combined with financial stresses, health concerns, and generalized fear of the future makes reproductive activity difficult. Some of those factors were already at work before COVID.

Falling birth rates are a problem because, as I often say, GDP is simply workers times productivity. At some point, you need more workers to sustain growth. This is why China dropped its one-child policy in 2016. So far, it hasn’t helped. The total fertility rate is still 1.3, one of the world’s lowest. It turns out that decades of teaching people to have only one child, and sometimes punishing those who wanted more, isn’t easily reversed by decree.

Last week China’s National Bureau of Statistics reported 10.62 million births, down from 12.02 million in 2020. This is roughly in balance with the number of deaths, which means (absent more immigration) the Chinese population will soon begin shrinking, if it isn’t already.

That’s not necessarily doom for long-term GDP growth. Higher productivity can compensate for fewer workers, at least for a while. But China’s population is aging, too. Older people are leaving the labor force faster than young people enter it. Many developed countries have the same problem but, as with other things, in China it’s much bigger.

The Chinese government is attacking this problem with various incentives, including cash rewards and longer maternity leaves. These may help but they’re clearly not enough. Xi will have a hard time reaching his other goals without solving this one, and soon.

Interestingly, Ren Zeping, a well-known Chinese economist with a huge social media following, suggested the Chinese central bank print 2 trillion yuan annually to subsidize parents having more children. This seems not to have been well received by authorities. His social media accounts are suspended and media reports say Ren is “not available” for comment.

“Culturally Stunted”

Dan Wang, Gavekal’s China technology expert, writes a long annual letter on his personal blog you really should read. It is fascinating and a must-read for me. He covers more subjects than I can mention here, so I’ll zero in on just one below. It needs a little set-up first.

Last year I wrote several times about Xi’s policies reducing the entrepreneurial activity that brought so many Chinese out of poverty and into the modern world. This doesn’t seem to be an accident; it is the plan. Party leaders have decided what they once called “capitalism with Chinese characteristics” is becoming a threat and must be suppressed.

While Dan sees this suppression as well, he’s more certain on something else I haven’t mentioned: China’s inability to export its culture.

One reason the US has so much “soft power” is that our cultural products dominate the world. I can remember, as far back as the 1980s, visiting remote parts of third-world countries where literally no one spoke English, but everyone knew the latest Michael Jackson lyrics. The lucky ones could watch our movies and TV shows. Some read our books. American entertainment was everywhere and it paid giant economic dividends.

China isn’t producing anything like that. Dan Wang explains why.

“While it’s too soon to say that regulatory actions have snuffed out entrepreneurial dynamism in China, it’s easier to see that a decade of continuous tightening has strangled cultural production. I expect that China will grow rich but remain culturally stunted. By my count, the country has produced two cultural works over the last four decades since reform and opening that have proved attractive to the rest of the world: The Three-Body Problem and TikTok. Even these demand qualifications. Three-Body is a work of genius, but it is still a niche product mostly confined to science fiction lovers; and TikTok is in part an American product and doesn’t necessarily convey Chinese content. Even if we wave nuances aside, China’s cultural offering to the world has been meager. Never has any economy grown so much while producing so few cultural exports. Contrast that with Japan, South Korea, and Taiwan, which have made new forms of art, music, movies, and TV shows that the rest of the world loves.

“The reason for China’s cultural stunting is simple: The deadening hand of the state has ground down the country’s creative capacity. The tightening has been continuous. Consider that The Three-Body trilogy had been published in Chinese by 2010, which was a completely different era. I think it’s quite impossible to imagine that this work can be published or marketed today. It’s not just the censorship related to direct depictions of the Cultural Revolution. A decade ago, the CEO of Xiaomi went on Weibo to share his thoughts on the book; today, few personalities speak up to say anything except the patriotic or the mundane. Therefore, I’m not terribly optimistic about the future of Chinese science fiction, which today has almost as many people studying the field as actual practitioners.”

(By the way, The Three-Body Problem he mentions is a science fiction novel by Chinese writer Liu Cixin, the first of a trilogy in which a future earth meets another civilization. It is indeed a work of genius, but little known in the West. I highly recommend it, not just for the fabulous plot and writing, but the insight into thinking from a Chinese perspective.)

If you have young children or grandchildren, they likely consume a great deal of Asian culture, but little of it is Chinese culture. They love Korean K-Pop music and Japanese anime. They probably use the TikTok app, which is nominally Chinese, but the video content shared on it is from everywhere.

(As an aside, I find it fascinating that China has forbidden anyone under 17 from playing video games during the week and limited weekend hours. I know some American parents might support such a good policy. I just wonder how micromanaging culture to such an extent will play out in the psyche of the students in the long run.)

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

China certainly has a rich and vibrant culture, aspects of which people anywhere would enjoy. The problem, as Dan says, is the government has no interest in promoting that kind of creativity. It sees information as a risk to stability. It’s hard to promote Chinese culture overseas without bringing more overseas culture into China, which the government tightly controls.

China has enough scale to produce excellent, varied cultural products. But at the end of the day, it’s still limited, lacking engagement with the 81% of the world that isn’t Chinese. It’s not just censorship, but a kind of neglect.

Xi Jinping seems to think that’s just fine. He wants China to stand on its own. Fair enough. But in so doing, he leaves a lot on the table. And he, or his successors, will probably find artistic creativity harder to suppress than business creativity. It will reappear in ways not so easily controlled. At least one can hope.

Muddling Through

My friend George Friedman of Geopolitical Futures released his 2022 forecast last week. He covers the whole world in his always-thoughtful way. (You can get a copy of the full report, plus much more fascinating content, by subscribing to Geopolitical Futures at a low special rate. Highly recommended.)

For China, George’s outlook is one we might term “muddling through.” He recognizes all the problems we’ve reviewed. China came a long way in recent years, but in the process generated both enormous debt and massive inequality. The latter is a problem for a regime that won’t tolerate social instability. Hence the new “common prosperity” push that is reducing the country’s growth potential. Stability is more important than growth.

Here’s George:

“Beijing will therefore spend the next year as it will spend much of the next decade: recalibrating its economic and financial systems without ushering in social unrest that could threaten the ruling party. Thus, the biggest danger to China will be internal divergences. The country is home to a variety of ethnic groups, some hostile to Chinese domination, with extreme variance of income and standards of living.

“The economy must grow, but it must grow more equitably. President Xi Jinping, then, is caught between the competing imperatives of growth and equality. It’s the same tightrope Chinese leaders have walked for centuries.”

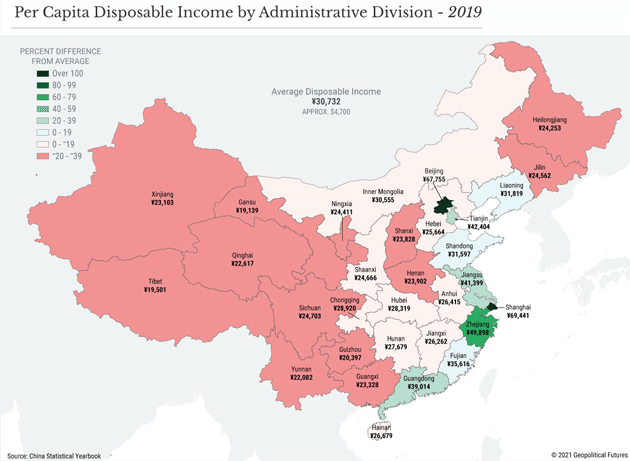

The GPF 2022 forecast has these two graphics showing the vast disparity of income by region. Average disposable income is anywhere from 2 to 3 times more in the major coastal provinces than in the western provinces.

Source: Geopolitical Futures

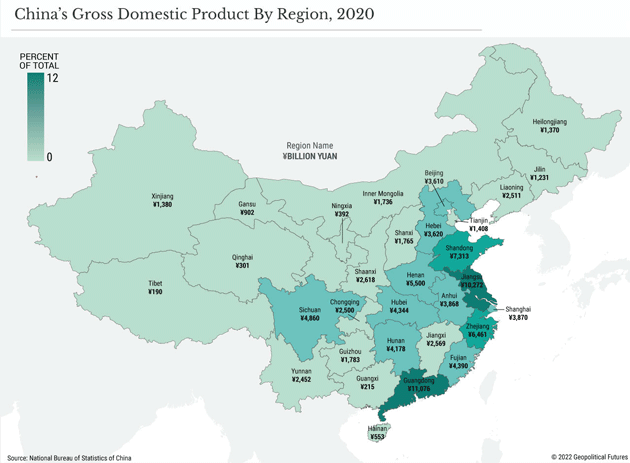

That is largely because the coastal provinces account for most of the country’s GDP:

Source: Geopolitical Futures

Those charts highlight China’s economic inequality. Technically, China has defined the poverty level at the equivalent of $2.30 a day. Of course each province makes sure their data shows only a small handful of people live below that level. But just like in the United States, that doesn’t tell the whole story. There is essentially little to no safety net in China.

Japan had the benefit of growing rich before it grew old. China is growing old before growing rich. Xi’s attacks on entrepreneurs will have a significant effect on future GDP growth, as will an aging population. China no longer has the luxury of being the world’s low-cost labor source. They are moving up the value-added chain (in some cases extraordinarily well) but will face significant competition from the rest of the world.

“Entrepreneurialism with Chinese characteristics” will be a significant change from the atmosphere Deng Xiaoping launched in the early 1980s. Every week we learn of more debt problems to the tune of hundreds of billions of dollars. One-time China analyst (and bull in China) Simon Hunt writes today:

“Ever since the debt and survival issues of Evergrande began appearing, we have been steadfast in saying that in the end the highly leveraged developers will be allowed to fail, that policies would be introduced to prevent social and financial systemic risks and that other than a handful of private real estate developers, SOEs [state-owned enterprises] will control the property market resulting in a better management of the ups and downs of this volatile sector with implications for local governments. In effect, control of the country is becoming centralized.”

The property market has been one of the Chinese economy’s main drivers. Local governments have long met their budgets by selling land to developers. The ability to do that is going away and somehow the money to run those cities will have to come from Beijing. More centralized control.

I don’t know how well Xi Jinping will walk that tightrope. Recent history suggests he will find a way, but it will have costs. I’m not suggesting China will fall into a recession or is not going to continue to grow and prosper. I’m saying it will do so more slowly, and slower growth is going to make it more difficult to deal with the income disparity and other social issues. It will also make China less predictable.

In any case, China’s efforts to control Omicron outbreaks will seriously impact 2022 global growth, not to mention exacerbate the supply chain problems. Through November 2021, the US bought $463 billion of Chinese goods. This year could be quite different.

SIC Planning

As things turned out, there was a snowstorm in Virginia so my trip turned into a virtual meeting. It’s funny how much time I spent traveling over the last 20 years. Now that I’m not traveling much, I seem to have more time but also more things to do in that time. One of them is planning the next Strategic Investment Conference, which I am determined to make the best ever. Mark your calendar for the first 10 days of May. You’ll have the chance to hear from experts on many topics in what I believe will be a very interesting time period.

With that, I’m going to hit the send button and wish you a great week! And don’t forget to follow me on Twitter!

Like what you’re reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Your spending a lot of time thinking analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Tags

Suggested Reading...

|

|

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin