Why become a VIP?

Here’s why...

An uber-successful money manager told me recently that the number one trait shared by great investors is their willingness to change strategies when they are wrong.

With endless amounts of financial data available, it’s easy to seek out only the data that support your premise and to ignore conflicting evidence...

And dogmatic investing usually leads to disaster.

Take the actions of investors in the aftermath of the 2008 financial crisis for example...

Watching the Fed inflate its balance sheet by 130% in just 12 months, many market observers concluded a devastating inflation must follow, which would force interest rates higher toppling the tall tower of government debt.

Investors who bought into this binary “If A, then B” analysis made some very bad decisions about their money, avoiding US stock and bond markets in favor of commodities and other inflation hedges.

With the S&P 500 up 225% since 2009 and the 10-year yield still 64% below its 40-year average... that would have been a serious misallocation of capital.

Besides being wrong, you can be really wrong...

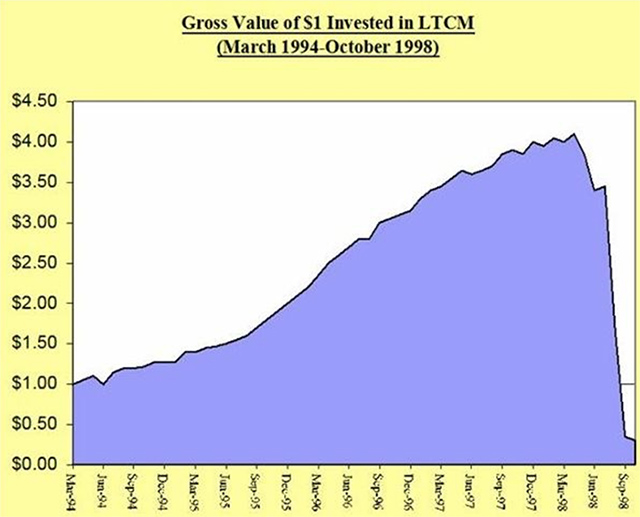

Like Long-Term Capital Management wrong...

Posting annualized returns of 40%, with $100 billion in assets under management and finance veterans, PhDs, and Nobel Prize winners at the helm, LTCM was destined for greatness...

But destiny expired when a strengthening US dollar led to the 1997 Asian financial crisis... which led to the Russian sovereign default... which led to...

The takeaway? Investors who fail to pay heed to changing markets are at great risk of making serious investment mistakes.

There are steps you can take to ensure your portfolio doesn’t follow the fate of LTCM... but more on that in a moment.

First, let’s take a look at some of the major disruptions ahead.

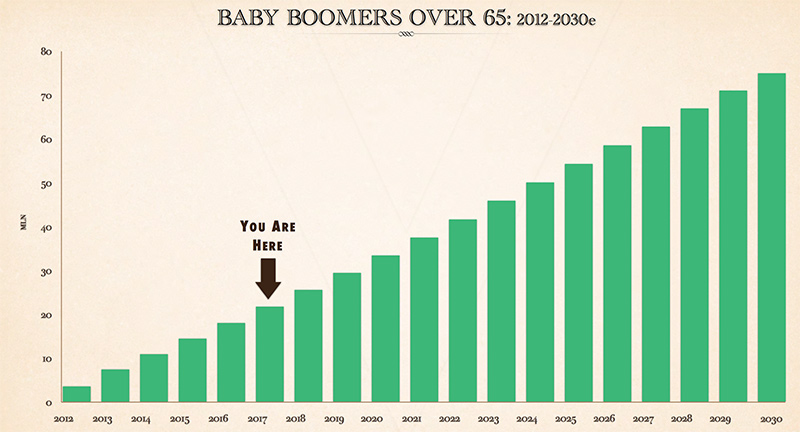

According to Pew Research, 3.5 million Americans turn 65 every year and will do for the next dozen years.

At the same time, the CDC found that the US fertility rate is at its lowest point since records began in 1909.

This disastrous combination means that those 65 and older will make up over 20% of the population by 2030... while the percentage of working-age cohorts will decline.

And with 54% of boomers having less than $50,000 saved for retirement, pension liabilities will increase at the same time that tax revenues decrease as a result of a shrinking labor force.

This trend also carries other economic problems.

When people enter retirement, their expenditures drop 40% on average. With consumption making up two-thirds of the US economy, this is a major deflationary force.

If we see low growth continue, is a 2.2% yield on the 10-Year Treasury a good bet?

Of course, that also depends on...

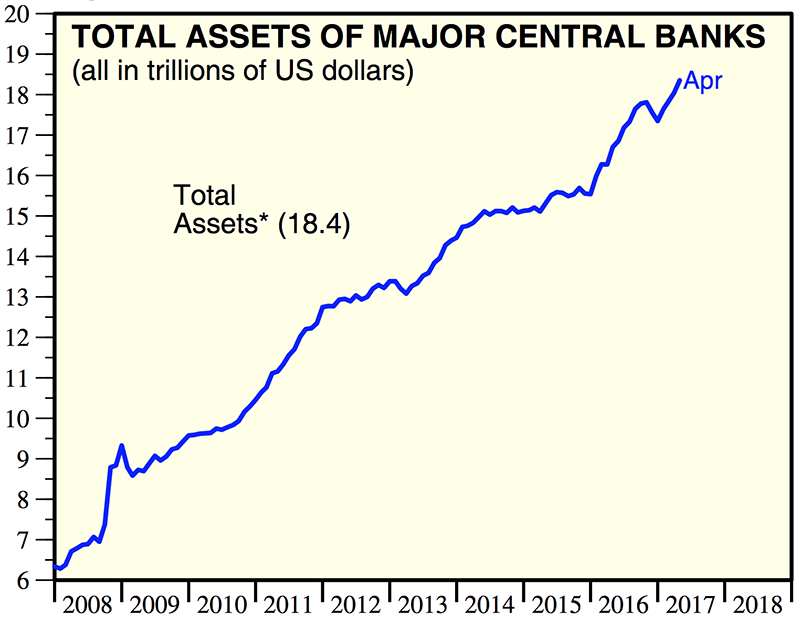

We learned from the Fed’s March meeting that the board of governors is having a serious discussion about reducing the size of its $4.5 trillion balance sheet.

Which means...

Every month, about $50 billion in bonds on the Fed’s ledger reach maturity, and the Fed buys new bonds to replace them. The first step will be to let the maturing bonds “roll off” the balance sheet.

If this happens, the price of bonds may drop, and interest rates could rise. For all intents and purposes, ‘’normalizing’’ the balance sheet equates to a series of rate hikes.

With markets expecting a boost from tax cuts and fiscal stimulus, the Fed risks spoiling the party by tightening faster than expected.

While the Fed is tightening, the $18.4 trillion global central bank balance sheet is still expanding by $1 trillion per annum, thanks to the ECB and the BOJ...

Will the Fed ‘’go it alone’’ with its tightening... strong dollar be damned?

With wide-ranging implications, monetary policy has the ability to put many a winning portfolio on the wrong side of the market.

Automation and advances in technology are redefining investment selection.

What do Tesla (which became America’s largest car maker by market cap in April) and Uber (which is valued at $70 billion in private markets) have in common?

Neither make money.

Amazon (whose stock price is up 220% since 2015) is now the fourth-largest company in the world by market cap.

With a P/E ratio of 187 and a net-profit/sales ratio around one-tenth of Microsoft’s, is it a “buy” at current valuations?

The question might seem rhetorical, but it’s not.

And here’s why...

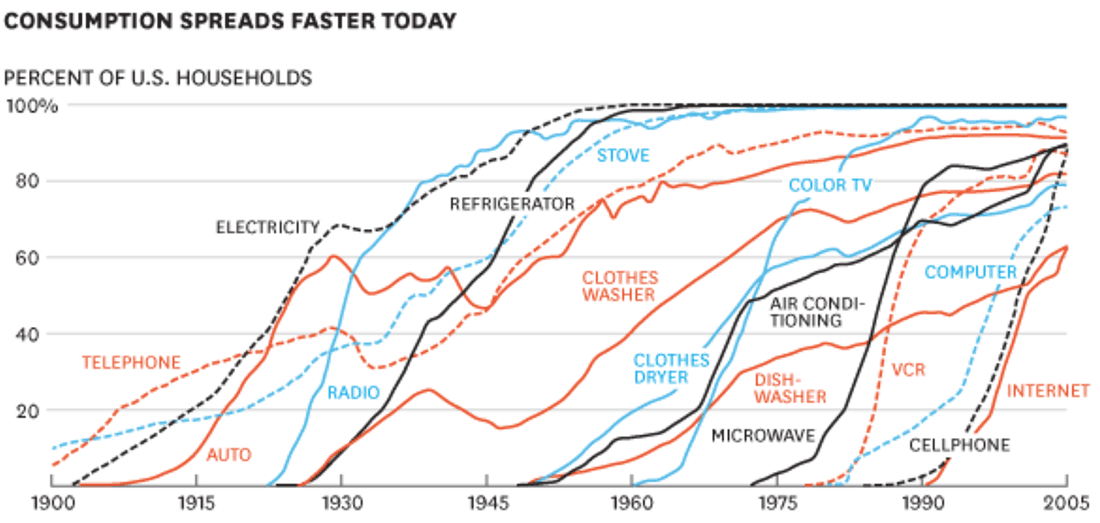

Over the past century, the technology-adoption cycle has been steadily compressing.

While it took approximately 50 years for electricity to be adopted by 60% of US households, (though not shown on the chart) it took smartphones only about five years to achieve the same penetration.

Automation and technology will continue to disrupt traditional industries... and consequently investment selection. The question is, will you be the equivalent of an early investor in Amazon? Or the one left holding Kodak?

Global trade increased by an average of 280% per annum from 1960–2014. However, that trend is now reversing, with trade falling by 20% in the last two years.

Exports and imports combined now amount to 27% of US GDP, versus 17% in 1987... Dow Jones calculates that companies on the S&P 500 generate 44% of their sales abroad.

That means falling global trade has serious implications for your portfolio.

The takeaway? The way these developments play out will alter the investment landscape—and the performance of your portfolio.

The good news is, these shifts don’t have to determine your investment success.

To quote the stoic master Epictetus:

Being a Mauldin Economics reader suggests you already understand the importance of keeping your portfolio on the winning side of unfolding disruption.

That’s why we are giving you a limited-time opportunity to become a Mauldin VIP.

In a minute, I’ll tell you about the very special limited-time opportunity to become a Mauldin VIP.

First, however, a word about Full-Spectrum Investing, an approach Mauldin VIPs leverage each and every day—with proven results.

If you accept that forecasting the future of financial markets with any kind of certainty isn’t possible...

...the only logical approach to successful investing is to select investments using time-tested, disciplined methods.

That’s where the Full-Spectrum concept comes in.

To show you how it’s being done, let me touch briefly on the work that Mauldin senior editor Patrick Watson does on behalf of subscribers.

Patrick Watson is a senior economic analyst and John Mauldin’s personally trained protégé.

Patrick has over three decades of experience in the investment industry, and his writing portfolio reads like a Who’s Who in financial publishing: Forbes, Business Insider, Investor’s Business Daily... to name a few.

At Mauldin Economics, he is the editor of Macro Growth & Income Alert and Yield Shark, two of our most profitable investment advisory services.

In case you’re unfamiliar with it, Macro Growth & Income Alert helps readers generate reliable income and capital gains using stocks and easy-to-implement, low-risk options strategies.

And Patrick, working alongside Robert Ross, has been doing just that...

If you don’t know Robert, he is the senior equities analyst at Mauldin Economics.

He previously worked at Merrill Lynch and has been on our portfolio management team since 2011.

Utilizing his quantitative prowess, Robert created the Mauldin Economics’ Equity Evaluation System (EES)...

The EES Model is a proprietary stock-selection system that uses 75+ criteria to find the best investment opportunities.

The combined return of the last eight trades Patrick and Robert have closed is 65.04%... and they have also generated an additional 1.82% from selling options since the beginning of 2017.

Year-to-date, the Macro Growth & Income Alert portfolio is up 10.2%... compared to 7.8% for the S&P 500.

And the portfolio’s open positions are set to bank even bigger returns for readers ...

There are six open positions in the Macro Growth & Income Alert portfolio, which are up a combined 81.03%...

The portfolio also has one losing position, which is down a small -0.34%.

Not bad when the S&P 500 has gone nowhere since March...

To give you an idea of how Patrick blends his trend-spotting macro perspective with Robert’s quantitative rigor, let’s delve into a recommendation they made in February, which is already up 14.5%...

The US is the world’s largest arms dealer... and to qualify for contracts, US defense contractors must source much of their materials from inside the border.

With Trump’s promise to rebuild the military and a potential border-adjustment tax on the horizon, US defense contractors looked interesting.

But there was a problem... diversification.

Most defense contractors earn upward of 70% of their revenues from the US. But if the domestic market turned sour, they could take a big hit.

So, Patrick and Robert, our dynamic duo, turned their attention to finding a more diversified player with rock-solid financials and found the world’s sixth-largest defense contractor.... the second-largest civilian aircraft manufacturer ... AND the largest US manufacturing exporter by dollar value.

Boeing is the name.... and profit is the game.

Boeing’s colossal aircraft empire is split into two main divisions: Boeing Commercial Airplanes and Boeing Defense, Space, and Security.

When combined, Boeing is the world’s largest aircraft manufacturer.

One-third of the firm’s revenues come from the defense side... and with the US military budget recently getting a $21 billion boost...

... Boeing is set to profit with their Super Hornet jet program... separately, the US Navy awarded them a $678 million contract in March.

Another positive for the company is the rising geopolitical tensions.

Boeing’s defense division relies heavily on funding from global defense budgets, which should continue to be robust as geopolitical turmoil continues.

The macro setup looks promising... and its fundamentals also pass with flying colors...

With $10.6 billion in cash sitting on the balance sheet, it has a sizable margin of safety...

...which is one of the reasons it hasn’t missed a dividend payment in over 20 years... and as a kicker, the stock currently yields 2.63%.

Boeing looks like a good company to own...

But to ensure we only recommend the best possible opportunities to readers, Robert ran over 100 of Boeing’s fundamental, valuation, technical, sentiment, and a handful of proprietary indicators through our equity evaluation system... which yielded results consistent with the rest of our analysis.

Whatever way the disruption unfolds, Patrick and Robert have your portfolio covered with their perfect blend of macro and micro expertise.

Jared Dillian is a senior editor and investment strategist at Mauldin Economics... and he’s something of a legend on Wall Street.

From 2001–2008, Jared worked at Lehmann Brothers where he became the head of ETF trading. At the age of 27, he was routinely trading over $1 billion a day in volume!

After Lehman’s demise, Jared swapped Wall Street for Myrtle Beach, South Carolina and continued sharing his insider knowledge of financial markets with a small but loyal following of institutional investors in his Daily Dirtnap missive.

Jared’s experiences—the good, the bad, and the ugly—during his Wall Street career are laid out in his acclaimed book, Street Freak: Money and Madness at Lehman Brothers... which Businessweek named the #1 General Business Book of 2011.

Jared’s high-octane writing has led to him becoming a regular contributor on Bloomberg View and Forbes...

But he keeps his real handiwork for Street Freak, a unique research service that leverages the lessons he learned from his years in the belly of financial markets... to deliver big gains to his readers.

Jared is an excellent, provocative, and highly entertaining writer whose work is closely followed by top money managers.

His specialty is uncovering “big ideas”—the powerful actionable trends traders dream of...

...And as financial markets become more volatile, having Jared’s big ideas on your side will be essential.

One of his big ideas that readers have been profiting ‘’bigly’’ from... is shorting Canada.

First, Jared shorted the Canadian dollar at US$1.01–$1.03, back in 2013...

It dropped a little over 30% by the time he exited the position... earning handsome profits for all involved.

But for Street Freak readers, the best is yet to come...

Jared has been closely following the impending Canadian mortgage crisis for a couple of years now...

Here’s Jared’s synopsis of a recent trip to Vancouver (he’s a “boots on the ground” type of guy):

It reminds me of San Francisco in 1999. Or New York in 2006. Loud, boisterous conversations on the streets, restaurants so loud you can’t even have a conversation. People talking about all this easy money they’re making.

People are happiest when the money is easy. I was telling my wife last night: I’m overall pretty happy. I’ve been successful. But it’s never been easy. It’s always been a struggle. Just for once, I would like it to be easy.

It is easy in Vancouver. Buy a house, watch it go up 100%. Buy another one.

Also heard lots of stories about people using their house like an ATM, just like what was happening here 10 years ago. Lots of HELOCs.

Also private lending. There is a lot of leverage in the system that is not on bank balance sheets.

I’ve had a bead on this trade since 2013, but now I have plenty of company. Lots of people jumping on the bandwagon. The big guys are weighing in. It is becoming fashionable to say that there is a housing bubble.

The bulls say that there is scarcity in Vancouver. Hemmed in by the water and the mountains, there is no place to go but up.

That was also true of a few places in the US (like NYC), but it didn’t stop houses from going down 30–50%.

As for Toronto, you have probably heard by now that house prices are up 33% year over year. That’s a bubble. It’s beyond a bubble. It’s a frenzy.

I told you so.

They are talking about a foreign buyer’s tax in Ontario, or an empty-homes tax, or even a capital gains tax. Nothing will stop it. It will end when it will end...

All of our short Canada positions are intact, and they will stay that way.

If you missed the news...

On April 25, the stock of Canada’s largest non-bank mortgage lender, Home Capital Group cratered 65%...

...After it disclosed it struck an emergency liquidity arrangement for C$2 billion to counter evaporating deposits...

By evaporating we mean 94% of the company’s deposits have been withdrawn in six weeks.

This could be the beginning of Canada’s long-awaited housing crash...

And Street Freak readers are poised to profit...

...Because Jared has taken out a number of short positions on vulnerable Canadian banks.

But Street Freak readers don’t have to wait for a Canadian crash to beat the markets.

Following Trump’s victory, the market was pricing in a Le Pen victory over in France... the non-consensus candidate had become consensus!

Jared, being the contrarian’s contrarian, took the other side of the trade, recommending a large-cap French ETF to subscribers...

The ETF has gained 23% since December.

In sum, the combined return of the last 12 trades Jared has closed in the Street Freak portfolio is 100.44%.

Jared’s unique synergy of Wall Street wisdom and contrarian thinking make him the perfect portfolio navigator for the coming disruption.

Which brings us to another critical component of Full-Spectrum Investing...

With valuation metrics at (or near) all-time highs across the board, now might be the time to think about spending a few bucks on downside protection...

After all, record levels of anything are records for a reason...

It’s the point at which previous limits were reached... and by definition is the sign of a maturing market.

This is where Kevin Brekke, the editor of our premium short-selling service, Rational Bear, takes the lead.

Kevin was previously the managing editor for a blue-ribbon team of global analysts at World Money Analyst, another Mauldin Economics publication.

Kevin’s painstaking attention to detail and three decades of investment experience make him the man for this requisite part of Full-Spectrum Investing...

All of us know we must insure our homes. Well, with Kevin’s help, you can learn easy-to-implement strategies that will insure your portfolio—and that’s no small thing, considering that the portfolios of many of our readers are worth more than their houses!

Rational Bear uses simple options strategies and inverse funds to help readers take advantage of grossly overvalued stocks facing near-term headwinds.

Kevin’s readers recently gained insight into how the portfolio will perform when the inevitable decline comes...

When the S&P dropped 1.24% on March 21st, Rational Bear’s positions were up a total of 9.4%... performing exactly as they should.

So, along with offering portfolio protection when the downturn arrives, Rational Bear is poised to profit.

Kevin and his readers understand short-selling is, somewhat counterintuitively, a long-game... but when the tide turns, it’s usually worth the wait.

For example, take George Soros’ infamous bet against the British pound:

Soros was short the pound for 30 months. That meant he had to write a check every month, for 2 ½ years... which cost him a fair number of clients and a lot of cash.

But then on one September day, Soros was right to the tune of $1 billion.

Nobody knows when the next major correction will hit; all we know for certain is that it will.

And every time a correction comes, the most astute investors are poised to profit:

Jesse Livermore made $100 million (roughly $1.38 billion in today's dollars) shorting the Dow in 1929

Paul Tudor Jones shorted the markets in 1987 and made $100 million on "Black Monday"

John Templeton shorted the dot-com bubble and netted $80 million in just a few weeks

John Paulson made tens of billions shorting subprime mortgages

And you can bet your bottom dollar none of them shorted the market the day before it crashed.

With Rational Bear and Kevin on your side, you will gain vital downside protection for the rest of your portfolio with securities poised to rise when broader markets go south... and shorting opportunities that allow you to profit from the decline.

In a letter to readers last week, Kevin detailed his latest short.

The company operates in an industry that is in terminal decline as a result of automation.

In April, the firm’s newly issued bonds tumbled to multi-year lows, amid signs that a key part of its business is faltering...

In fact, Morgan Stanley’s base case for this sector is a 20% decline in the next four years... and that’s bad news for the firm who is holding $8.9 billion in debt tied to the sector’s performance.

As always, Kevin executed this trade using a simple and easy options strategy that limits risk while leaving the upside wide open.

If you want to get the name and all the information on this short... plus access to all Kevin’s other deeply researched trades, we will rush to them to you by return email...

You can get access this information by clicking the link at the end of this page, but first...

Patrick Cox, the senior editor of Transformational Technology Alert has lived deep inside the world of technology breakthroughs for the past 30 years.

He has written over 200 editorials for USA Today and has appeared in the Wall Street Journal and on CNN's Crossfire television program.

Patrick’s three decades of first-hand experience in the biotech sector, coupled with the analytically savvy Mauldin Economics team, have put Transformational Technology Alert readers in prime position to profit from the rapidly unfolding wave of technological disruption.

And there is no bigger disruptor than biotech.

For example, as recently as 2001, the cost of sequencing a person’s genome was upward of $100 million.

Today, the price has experienced a waterfall drop to $1,000—less than the cost of a chest X-ray—and it will continue to fall. By end of the decade, it is estimated that sequencing your genome will cost less than $1.00!

And that’s just one of dozens of dramatic advances underway in the biotech sector. This will literally change the world.

With dramatic change, comes dramatic opportunity...

Of the 11 winning positions Patrick has recommended and ultimately sold, ten have returned more than 50%... with six returning more than 100%. As can be expected in such a fledgling industry, the portfolio has also had seven losing positions.

As for open positions...

A recommendation Patrick made in November, a development-stage medical device company which is transforming huge industries like oncology and dermatology is up 365%... and his March recommendation is already up over 20%.

Just like early investors who made fortunes in technologies like the Internet, video streaming, social media, online shopping, etc.—with Patrick as your guide, you’ll get positioned early on in the super-star companies turning health care on its head...

...investments you can make today and profit from over months and years as they transform the world.

In a world teeming with financial research and analysis, how do you determine what’s worthy of your time?

You could spend all day, every day sifting through research papers and reports to try and identify the information that matters in charting your investment course.

So wouldn’t some type of filter, which only shows you the crème de la crème of financial research, be worth its weight in gold?

We have the filter...

You can join the elite group of people who can call John Mauldin their personal research assistant with John’s research service Over My Shoulder.

John filters the mountains of expensive research he receives on a daily basis to send you the highest-quality, wide-ranging analysis from the most respected individuals and companies in economics and finance.

In the last month alone, John has gifted readers exclusive research from Steve Blumenthal, Ray Dalio, Louis Gave, Barry Ritholtz, and Howard Marks... plus many more.

Much of this research is accessible only by having a six-figure account with these managers or paying tens of thousands of dollars in fees.

If you want the latest expert insight into our economy and markets, John Mauldin’s Over My Shoulder has you covered.

My name is Olivier Garret, partner and CEO of Mauldin Economics.

It’s my great honor to work with John Mauldin, Ed D’Agostino, and our many editors and analysts to publish what we believe is some of the highest-quality investment research available anywhere.

As we hope we have made clear, there’s never been a more critical time to have access to the level of research offered by seasoned professionals like Patrick Watson, Robert Ross, Jared Dillian, Kevin Brekke, and Patrick Cox.

These professionals can work on your behalf to identify and monitor investment opportunities (and risks) for the coming disruption.

Today, you have the chance to access ALL of this invaluable research at one low price:

Mauldin VIP is our way of giving our most valued subscribers the opportunity to experience ALL of the Mauldin Economics research services for one low price.

As a Mauldin VIP, you receive every issue, every alert, and full access to the archives for all of these investment advisory and research services:

Macro Growth & Income Alert (a $1,995 value per year). The premium alert service from Patrick Watson and Robert Ross that capitalizes on macro trends to earn capital gains and extra income.

Rational Bear (a $2,495 value). Kevin Brekke’s solution for making money on the downside, with a combination of carefully picked securities, sensible shorting, and easy-to-use options strategies.

Street Freak (a $299 value). Jared Dillian’s macro-trends letter—big-game hunting from the viewpoint of a former Wall Street trader.

Transformational Technology Alert (a $1,495 value). Patrick Cox’s research and recommendations on biotech breakthroughs.

Yield Shark (a $199 value). Patrick Watson’s high-yield income advisory service with the best ETFs, bonds, dividend-paying stocks, and more.

Over My Shoulder (a $179 value). John Mauldin’s unique research service that delivers some of the world’s most important research directly to you.

Plus, you’ll receive the Mauldin VIP Week in Review. A short-read summary that saves you time by recapping the key recommendations from the previous week and helps you manage the full spectrum of information you’ll be receiving.

And that’s just the beginning. You’ll also receive:

Jared Dillian’s ETF Master Class (a $299 value). The former head of ETF trading at Lehmann Brothers takes you through a five-part series covering everything you need to know about ETFs... how to use them in your portfolio... and how to avoid their hidden dangers.

Our two-part “Investing In The Age Of Trump” Virtual Conference Video (a $499 value). John Mauldin and Jared Dillian recently sat down with top asset managers and economists to discuss how to profit from the changing landscape... and just as importantly, how to avoid the pitfalls.

A NEW special report on tail risk (a $99 value). In this report, Rational Bear editor Kevin Brekke dissects various “tail risks” in the markets. The term “tail risk” originates from the Bell Curve, or so-called normal distribution of results. Tail risk refers to the risk of an asset or portfolio of assets moving more than three standard deviations from its current price.

In this new special report, Kevin details how you can ensure against tail risk downside... and generate outsized returns in the event one of these black swans lands.

If you were to subscribe to these services individually, it would cost you $6,662 per year... and it would be worth every penny.

As a Mauldin VIP, however, you pay just $2,475, .. a 63% discount!

There’s more: As a VIP, you’ll also get full access to the archives of all the research services included.

The only “catch” is that you must become a Mauldin VIP before midnight on June 19. At that time, this exclusive service will again close and stay closed for a minimum of six months....

...And when it does reopen, it will be at a significantly higher price than what you can get VIP membership for today.

In other words, this is the lowest price the Mauldin VIP membership will ever be offered at...

... And year after year, you can continue to receive Mauldin VIP at the same low price – it’s locked in for as long as you remain a Mauldin VIP member.

So, why are we offering such incredible value for our most important research? Simply because we believe the best way to create lifelong clients is to help investors achieve more clarity and confidence.

Providing you with complete access to our premium services gives you the best chance to assemble a winning portfolio for the tumultuous road ahead.

You win; we win.

You have 30 days to decide if it’s for you. If you’re not 100% satisfied—for any reason whatsoever—simply cancel within those 30 days for a no-questions-asked, full refund of every penny.

After 30 days, you can still cancel at any time, and we will rush you a pro-rated refund on the remaining term of your Mauldin VIP subscription.

Of course, if you already subscribe to any Mauldin Economics publication or multiple publications included as part of Mauldin VIP, we’ll credit the remaining months of those subscriptions to your Mauldin VIP enrollment, so you pay less than $2,475 if you respond today.

You have nothing to lose from becoming a Mauldin VIP today.

Remember, the Mauldin VIP is open for enrollment only until June 19 after which it will close again.

Therefore, I would urge you to act now while this deeply discounted offer is in front of you.

Below, you’ll find the link to our ultra-secure sign-up form.

If you have any questions, even now, please don’t hesitate to contact us. You can reach us Monday through Friday, 7:00 a.m. to 5:00 p.m. Arizona Time. If you live in the US, call 1-877-631-6311 (toll-free), or if you live outside the US, call 1-602-626-3100.

We look forward to welcoming you as a Mauldin VIP.

Limited-Time Offer

Click Here to Get Started

Sincerely,

Olivier Garret

Partner and CEO

![]()