Dear Investor,

A series of Paradigm Shifts are taking place.

Paradigm Shifts aren’t merely cyclical events like bull and bear markets...

It’s when the usual and accepted way of doing things fundamentally changes... a revolution in how the world functions, if you will.

Today, there are multiple Paradigm Shifts occurring simultaneously... deglobalization, rising populism, a rearranging of international relations, and automation (to name a few).

As investors, it’s essential that we understand the risks these Paradigm Shifts carry... so we can position our portfolios to be on the winning side of them—and, perhaps even more important, to avoid the consequences of being on the wrong side.

These shifts are highly disruptive... but not to be feared. By arming yourself with the right analysis and insights, you can make these unfolding trends your friends.

And that was the single-minded goal of John Mauldin’s Strategic Investment Conference 2017... to provide you with expert insights into the Paradigm Shifts occurring now... and show you how to best take advantage of them.

Among the Paradigm Shifts dissected at the SIC 2017 were...

Data from the World Bank shows global trade increased by over 15,000% from 1960–2014. However, that trend is now reversing, with trade falling by over 15% since 2014.

Foreign direct investment has also dropped sharply from its 2007 peak... to levels last seen in the 1990s.

The benefits of free trade, which had for so long been universally accepted, are now being called into question. In fact, according to Thompson Reuters, there are now more trade barriers between countries than at any other time in modern history.

The move toward protectionist policies is a major sea change in how global commerce will function. And according to expert George Friedman, a speaker at the SIC 2017, this could bring down the European Union within the next year or two.

The investment implications at both the macro and micro levels are profound.

Since the end of WWII, centrist candidates have dominated the political arena. However, following the global financial crisis, many came to believe this system had failed them... and they want change, whatever form it takes.

History has proven that during times of economic hardship, Paradigm Shifts in politics occur. The current Paradigm Shift began with Brexit and the election of President Trump in 2016, and that was only the start...

Bridgewater Associates, the world’s largest hedge fund, has shown that support for populism is usually preceded by high levels of unemployment, income inequality, and increased immigration. With all three criteria present today, we are likely to see increasingly radical politics adopted in the coming years.

As today’s economy has become completely politicized, fundamental changes in politics greatly effects investors. While there is currently an outbreak of optimism that President Trump can succeed with his reform agenda, the forces lined up against it are considerable. What happens if his administration fails to reduce regulations or revamp the tax code?

At the SIC 2017, investors received a comprehensive briefing on the Paradigm Shifts in the US and global political scenes and discovered ways to shield their portfolios from rising political risk.

Trump’s “America first” policies risk ending the 70-year era of Pax Americana—US hegemony in global security and trade.

Meanwhile, Europe is increasingly fragmented as tensions rise over the unresolved problems from the financial and migrant crises.

Across the Middle East, a dangerous game of geopolitical chess is being played out by the US and Russia.

And tensions have reached the boiling point in Asia, with the problems in North Korea and China threatening to spill over into the rest of the region.

The last time we saw this setup was prior to the outbreak of WWII.

With the US and EU focused on sorting out their own problems, an international leadership vacuum is opening up.

As tensions rise between nations, geopolitics has rarely weighed so heavily on our portfolio decision making as it does right now... so that's where we looked for answers at the SIC 2017.

The Federal Reserve is on a clear rate-hiking path... but its counterparts at the ECB and BOJ are still buying over $120 billion in assets between them per month... and holding interest rates below zero.

In the era of currency wars, how long can the Fed "go it alone" without sending the dollar skyward?

Eight years of quantitative easing and a zero interest rate policy have distorted asset prices in every facet of the market... and where asset prices go from here will greatly depend on the Fed.

Where does the Fed go from here? Where should you put your capital with such a distortion in asset prices?

These were the questions that were answered by Federal Reserve insiders and top asset managers at the SIC 2017.

Globalization may have gotten the blame for the five million manufacturing jobs that have vanished from the US since 2000. However, it’s the robots who have taken 88% of those positions.

A 2013 study from the University of Oxford concluded that 47% of jobs in the US will likely be automated over the next two decades...

But automation and advances in technology aren’t just affecting manufacturing workers—they also have profound implications for investors.

Take Tesla, for example. Despite not making any profits, Tesla (which promises to fundamentally change how cars work) became America’s largest car maker by market cap in April. But is it a good investment, even at today’s elevated prices? And what about Amazon, which continues to redefine retail?

Investors who are unprepared for the automation Paradigm Shift could suffer a fate similar to the five million manufacturing workers who found themselves out of a job.

On the other hand, being on the right side of this shift could guarantee you years of steady profits.

As the Paradigm Shifts fundamentally change how the world functions, they are potentially perilous for investors.

Take the rise of the automobile and telecommunications industries in the 20th Century...

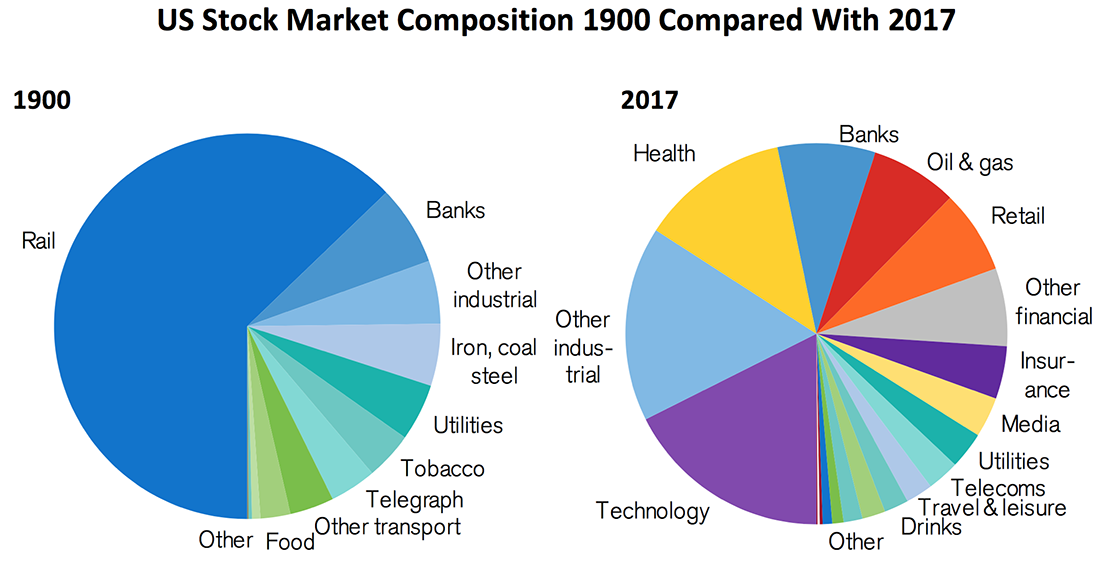

According to Credit Suisse, more than 80% of the publicly listed US firms in 1900 came from industries that today are near extinct. In contrast, 62% of US firms listed today operate in industries that didn’t exist in 1900.

Investors who bet on the right side of this Paradigm Shift (the rise of technology) profited from one of the most transformative centuries in human history... while those who failed to pay heed to the changes saw their portfolios enter terminal decline.

The current rise in extreme politics and geopolitical tensions mirrors those that took place in the 1930s... when authoritarian leaders came to power and war engulfed the world.

Lest we forget, the 1930s was a decade during which the Dow dropped 85%... and then fell another 50%. Even the legendary investor Benjamin Graham was down 60% over the course of three years.

But despite this challenging environment, there is a way you can profit from these unfolding disruptions. It’s just a matter of preparation. And that’s where the SIC 2017 comes in.

It was perhaps the most timely and important SIC ever.

The Mauldin Economics Strategic Investment Conference, now in its 14th year, has become one of the industry’s premier gatherings. With another A-list lineup of strategists, analysts, and geopolitical insiders, this year’s event promises to be the best yet.

The quality of speakers is world class and the topics were highly relevant.

– Steve S.

Hands down, the best conference I have attended in 40 years.

– Lisa F.

Everything: quality of speakers, agenda, venue, attendee participation was brilliant.

– Patrick K.

Incredibly smart and thoughtful speakers. The speaker panels are great, would have loved to let a few of them continue. The App is AWESOME, and was a really helpful tool and resource.

–Joel B.

The access to these speakers is amazing. This info you cannot get via newsletters or public media. Plus—great investment ideas. Liked the mix of geopolitics, investments, politics, etc.

– Elizabeth J.

Great lineup of speakers and efficiently run sessions.

– Gregor K.

That was the theme of the 2017 Strategic Investment Conference—and it struck a nerve with everyone from hedge fund managers to individual investors to those simply concerned about their financial future.

And the conference lived up to its stellar reputation. 26 of the finest analysts, asset managers, strategists, forecasters, and historians gathered in Orlando and took on the Paradigm Shifts’ most pressing questions, such as:

How can you structure your portfolio to profit from the continued disruption?

What do the rising geopolitical tensions and breakdown of international relations mean for financial markets?

Can the US economy overcome the structural headwinds it faces and achieve meaningful growth again?

What are the biggest risks building in global markets today?

Where is the US economy in the current economic cycle and when will the next recession hit?

Will the Fed reduce their balance sheet or are we destined for QE infinity?

Can China continue its unprecedented credit growth without a hard-landing?

Armed with key tools, actionable investment advice, and visionary insights from the SIC, you can survive and thrive during the Paradigm Shifts and beyond.

And with the SIC Virtual Pass, you can benefit from the heated debates, expert analysis, and revolutionary idea-sharing from the comfort of your own home.

Order your Virtual Pass today and secure 22 hours of audio sessions recorded live at the SIC, plus info-packed slide presentations from our speakers, and a special video featuring the highlights of the sold-out conference.

People say John Mauldin has the best Rolodex in the financial industry. Every year, he gives it a good spin and brings both old friends and new faces to the SIC—and 2017’s lineup of experts and insiders was truly exceptional.

To give you a taste of what you can expect, here are a few highlights:

Matt Ridley also known as “The Rational Optimist” (and it’s the title of his bestselling book) is a prolific writer on economics, evolution, and society among other topics.

Matt travelled from England to address the SIC 2017 on the economic, scientific, and geopolitical effects of the Paradigm Shifts over the next decade.

As a member of the House of Lords, Matt is deeply involved in the Brexit conversation. He understands the major challenges ahead, but with the "the ascent of man" (the longest bull market in history) ongoing, he sees no place for apocalyptic pessimism about the future of the world.

Ian Bremmer is the president and founder of Eurasia Group, the leading global political-risk research and consulting firm.

Dubbed a “rising guru” in the field of political risk by The Economist, Ian deals in person with heads of state and business leaders across the world. With a network of experts and resources in over 90 countries, Ian has first-hand knowledge of decisions being made at the highest level of government and business.

Corporate leaders spend small fortunes to access Ian’s insights. But at the SIC 2017, the audience heard his comprehensive analysis on the risks emanating from the powerful geopolitical changes now underway... as well as the international leadership vacuum that has opened up.

Marc Faber is the publisher of the long-running Gloom, Boom & Doom Report newsletter and an investment advisor to high net worth individuals.

With four decades of experience in the investment industry, Marc is well known for his contrarian investment approach and is credited with warning investors to exit the stock market prior to the 1987 collapse and for forecasting the bursting of the Japanese bubble in 1990.

Marc also warned of the problems that led to the 2008 financial crisis, stating in August 2007 (just six weeks before the S&P 500 hit its peak) that “a de-leveraging now in motion would lead to a decline in asset prices.”

At the SIC 2017, Dr. Faber shared his rationale that equity markets are wildly overvalued today, and he will discuss assets that are likely to do well in the months ahead.

George Friedman is the chairman and founder of Geopolitical Futures, a firm dedicated to forecasting the course of global events.

In his 2009 New York Times bestselling book titled The Next 100 Years, Friedman made a number of prescient forecasts, many of which are already in motion including the fragmentation of the EU over economic issues, a conflict in Ukraine, and the decline of China’s economy.

George Friedman’s expert analysis has led him to regularly brief senior commanders at the Pentagon. Attendees at the SIC 2017 tapped into George’s inside knowledge of the investment implications of rising geopolitical tensions.

Mark Hart is the chairman and chief investment officer of Corriente Advisors. While his name may be little known outside of a small hedge fund clique, Hart is one of the most successful fund managers around. He sextupled his money during the US housing bust... and doubled it again one year later by shorting European sovereign debt.

Mark almost never speaks at conferences, so having him share his insights and high-conviction investment ideas at the SIC 2017 was a real treat. Mark can spot trends and opportunities that the rest of us can never even imagine. His session is not to be missed.

Neil Howe is a renowned authority on generations: who they are, what motivates them, and how they are shaping America’s future.

Howe is best known for his book The Fourth Turning, which is one of the main influences on current White House Chief Strategist Steve Bannon’s political thinking.

Fourth Turnings typically bring wars, conflict, and generational strife. At the SIC 2017, Neil pinpointed where we are in this Fourth Turning and share his unique insights into how he sees it unfolding.

Marin Katusa is a New York Times bestselling author and one of the most successful portfolio managers in the resource sector.

One of his funds, the KC50, has outperformed the comparable index, the TSX.V, by over 500%. As founder and chairman of Vancouver-based Katusa Research, Marin is one of the most trusted and well-connected individuals in the resource industry.

Dr. Pippa Malmgren is a former presidential advisor who served on the National Economic Council in the White House under George W. Bush.

Pippa currently serves as a non-executive board member to the UK Department of International Trade, advising the government on trade during the Brexit negotiations.

Through her DRPM Group, Pippa advises global investment banks, sovereign wealth funds, and policymakers on emerging economic and political risks.

At the SIC 2017, Pippa presented her expert insights into markets, geopolitics, and policies to break down the Paradigm Shifts and identify investable trends arising from them. A dynamic presenter, expect to be blown away.

Martin Barnes is the chief economist of BCA Research, a world leader in global macro research.

Martin has been a confidante to central banks around the world since 1979 and has deep connections with a long line of Fed governors and chairmen.

As the current economic expansion is now the third-longest in US history, many investors are asking where are we in the cycle... and Martin, who has conducted extensive research on economic cycles and their investment implications, had the answers.

John Mauldin is the chairman of Mauldin Economics and author of Thoughts from the Frontline, a weekly newsletter he started in 2000 and is now one of the most read services of its kind in the world.

When investors, financial professionals, and discerning citizens need a macro view of what’s going on in the economy, they turn to John... and for good reason. John has dedicated more than 30 years to keeping people informed about financial risk.

From his warning of an impending recession in 2000, to a polemic on the Obamacare “death spiral” in 2016, John has blazed his own trail as one of the most respected macroeconomic minds in the field. At the SIC, he shared his wisdom, which is always loaded with investment ideas.

David Rosenberg is the chief economist and strategist for wealth management firm Gluskin Sheff. David was previously the chief North American economist for Merrill Lynch, where he was frequently ranked in the Institutional Investor All-Star Analyst rankings.

For two decades, he has been distilling his latest insights into a daily incisive report, “Breakfast with Dave.” Fortune magazine declares that it “has consistently nailed economic projections.”

David is a mainstay at the SIC and always gets some of the best ratings in our attendee surveys. This year was no different with David making a big call related to the bond market.

Mark Yusko is founder, CEO, and chief investment officer of Morgan Creek Capital Management, which advises pension funds, endowments, and high net worth individuals.

Prior to forming Morgan Creek, Mark was chief investment officer of both the University of North Carolina and the University of Notre Dame where he turned struggling endowment funds into top national performers.

Mark is a crowd favorite at the SIC... and for good reason: He delivers more investment ideas per hour than most analysts have in a month.

Dr. Harald Malmgren. From JFK through the Ford years, Harald was a major player in every significant trade deal... working for presidents, companies, and Congress.

Grant Williams has three decades of experience in the finance industry and has held senior positions at a number of investment banks and brokers in locations as diverse as London, Tokyo, New York, Hong Kong, Sydney, and Singapore.

Louis Gave is a former financial analyst at BNP Paribas. In 2002, Louis launched Gavekal Research, a leading research firm based in Hong Kong that focuses on developing original investible ideas based on global trends.

At the SIC 2017, Louis shared his first-hand knowledge of what’s really going on in Asia, specifically China. This is critical information for every investor.

David Zervos, a former Federal Reserve economist, is the chief market strategist for Jefferies, a global investment banking firm.

David, who served as an advisor to the Fed’s Board of Governors following the financial crisis, exchanges ideas with the world’s leading hedge funds, pension funds, and sovereign wealth funds on a daily basis.

Jared Dillian is the editor of Street Freak and The 10th Man at Mauldin Economics. A die-hard contrarian with a razor-sharp mind and irreverent wit, Jared is the former head of ETF Trading at Lehman Brothers and a master of market psychology.

Dr. Lacy Hunt is the executive vice president of Hoisington Investment, a firm that manages $6.5 billion for pension funds, endowments, and insurance companies. Previously, Dr. Hunt served as the senior economist for the Dallas Fed.

With his insider knowledge of how the Fed operates, he gave a special presentation on the ways that central banks and money flow affect the economy... and rest assured, Lacy’s presentations are always brimming with investment ideas.

Raoul Pal writes and publishes The Global Macro Investor, an elite macroeconomic and investment research service for the world’s leading financial institutions and sovereign wealth funds.

Raoul is also a Goldman Sachs alumnus, having co-managed its hedge fund sales business in Equities and Equity Derivatives in Europe.

Raoul tightly restricts the number of subscribers to his premium service, so the SIC attendees got a special treat having him in attendance and sharing his thoughts... for a fraction of the usual cost.

Lakshman Achuthan co-founded the Economic Cycle Research Institute (ECRI) in 1996. The company’s ability to call the economy’s turning points has made ECRI a trusted advisor of Fortune 500 companies, major asset managers, and governments across the globe.

With 20 years of experience in cycle research, Lakshman knows better than anyone else where we are in the economic cycle... not just in the US, but globally.

Ross Beaty is a resource entrepreneur and an internationally recognized leader in both non-renewable and renewable resource development. Ross has over 45 years of experience in the international minerals and renewable energy industries, making billions for his investors in the process.

Ross is the go-to guy for all things energy... and with the sector currently in limbo, his unrivaled insights made for memorable presentations and roundtables.

Peter Boockvar is the chief market analyst with the Lindsey Group, a high-end investment and economic analysis firm.

Peter has spent time working for various New York hedge funds as an equity strategist and portfolio manager. He is also the editor of The Boock Report through which he churns out more expert financial analysis and commentary in a day than most do in a month.

Peter usually only gives private client presentations, so it was a real pleasure having him at the SIC this year.

Patrick Cox is the editor of Transformational Technology Alert at Mauldin Economics. Having lived deep inside the world of technology breakthroughs for the past 30 years, Patrick has a clearer view than most on the ways in which technology will disrupt the upcoming decade.

Dr. Ray Takigiku is the co-founder, president, and CEO of Bexion Pharmaceuticals, a clinical-stage company developing cures for cancer.

Dr. Michael West is the CEO of BioTime, Inc., a leading clinical-stage biotechnology company in the field of regenerative medicine.

Dr. Alex Zhavoronkov is the CEO of Insilico Medicine, Inc., a company with a mission to extend healthy longevity. Insilico applies the latest advances in deep learning to drug discovery and biomarker development.

The key to successful investing is not picking winners, it’s avoiding losers.

– Louis Gave, Co-founder and CIO of Gavekal

The US-China relationship today is unsustainable, and that worries me.

– Ian Bremmer, President and Founder of Eurasia Group

The Federal Reserve has left a big mark on the economy in the last 100 years. We have had 18 recessions since 1915, and each of them were preceded by Fed tightening cycles.

– Dr. Lacy Hunt, Executive Vice President of Hoisington Investment Management

Since 2012, the S&P 500 earnings haven’t changed—yet the stock market is up 70%. When this expansion ends, the decline will be massive.

– Mark Yusko, Founder and CEO of Morgan Creek Capital Management

Listen to the expert insights and discussions from the SIC at your leisure...

Order your Virtual Pass today, and you can look forward to:

22 hours of audio sessions: Prepare your portfolio for the Paradigm Shifts with the help of top analysts, asset managers, strategists, and more.

Information-packed slide presentations: Each speaker's session comes with their slide presentation, so you can peruse key points and data at your leisure.

A hassle-free format: Your MP3 download means you can listen to the SIC 2017 anytime, anywhere, and on almost any device.

You can order the Virtual Pass right now for only $450.

When we wrap up production of the audio (approximately one week after our final panel takes to the SIC stage), we'll upload the Virtual Pass to a buyer’s-only website for you. And of course, we’ll inform you when your Virtual Pass is ready to download.

The time to start preparing your portfolio for the Paradigm Shift is now...