|

A letter from John Mauldin Chairman, Mauldin Economics |

There’s a string of crises about to hit financial markets, and they have the potential to destroy your portfolio

Today, I want to show you how to prepare for the coming turmoil and take advantage of the opportunities it will present

Dear Friend,

I have some unsettling news for you. Every aspect of your life—from your source of income to the social fabric of your community—is about to see major disruption.

For starters: Your job, whatever it may be, will likely disappear in the next decade. And that’s not just my opinion—McKinsey and PwC put the odds at around 50%—unsettling.

Simply, it’s all because the period I have been writing about for the last few years, “The Age of Transformation” is upon us.

Now, transformation isn’t all bad. Sometimes it jolts us out of our too-comfortable routines and makes us face a new reality head-on. It also presents once-in-a-lifetime opportunities.

Because I want you—my loyal readers—to experience transformation positively, I’ve made it my personal mission to help you prepare, starting today.

Before I get into how we are going to do that, I want to show you exactly why we must prepare for the Age of Transformation.

5 Reasons I’m Preparing for the Age of Transformation, and Why You Should Too

The bubble in government promises

has started to burst

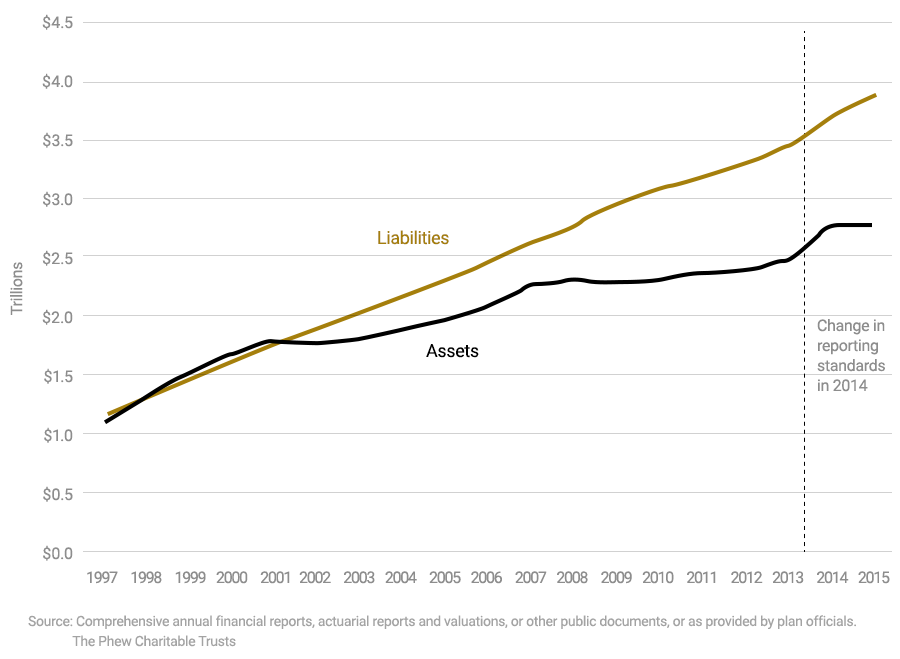

Unfunded pension liabilities at the state and local levels have quintupled in the last decade to roughly $4–$6 trillion. That’s a massive problem, given that combined state and local revenues total around $2.6 trillion per year.

This is all before we take into account a recession, which will almost certainly happen in the next 5 years—and I really think sooner.

Following that, the unfunded pension liabilities for state and local governments will be roughly three times the revenue they are collecting today.

In the past few years, cities like Detroit, Stockton, and Harrisburg have filed for bankruptcy.

It looks like Hartford, Connecticut could be the next domino to fall—with the city needing at least an additional $40 million in annual state funding to stave off insolvency.

Hartford has looked to the state for help, only to find its financial situation is also a mess. Connecticut is on track to run a $3.5 billion deficit over the next two years.

But even that seems like a minor problem, when compared to the $50 billion in unfunded pension liabilities the state has.

Hartford and Connecticut’s plight is simply a microcosm of the problem across the entire US.

I believe we’re now very close to the tipping point of the retirement and pension crisis we started hearing about 20 years ago.

And unfortunately, it’s not only public pensions that are in disarray. According to BlackRock, the world’s largest asset manager, the average retiree has only $136,000 saved for retirement. That equates to an income of around only $9,000 a year during retirement.

The disastrous combination of insolvent pension systems and massive savings shortfalls means many of the 3.5 million Americans who turn 65 over the next dozen years aren’t going to have the retirements they planned for.

As I’ve said before, this pension and unfunded government liabilities crisis is one we can’t muddle through. It’s so big that it will affect each of us in some way. That’s why you need to start preparing for the turmoil, now.

$20 trillion in debt doesn’t matter,

until it does

Having ballooned by over 120% in the last decade, total federal debt now stands at $19.85 trillion. That’s more than one full year of the entire nation’s collective economic output.

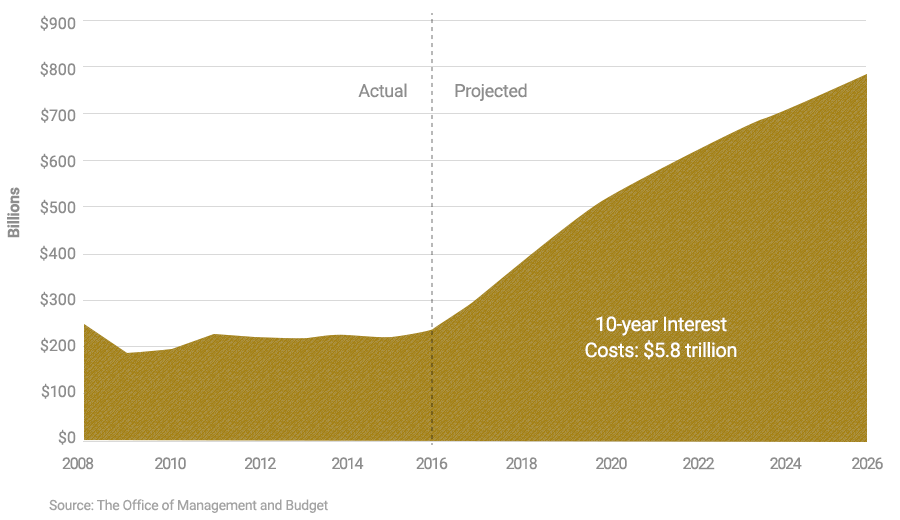

Servicing this massive debt pile has only been possible because of the Federal Reserve’s willingness to keep interest at emergency levels since 2008. However, the rising interest rate environment spells trouble for the largest debtor nation in history.

According to the Office of Management and Budget (OMB), by 2020 (just three short years from now), the interest on the national debt will almost double to $474 billion. That’s assuming the yield on the 10-year Treasury doesn’t rise above 3.8%.

By 2026, the OMB projects that figure to be $787 billion–assuming the 10-year yield stays at 4% or below.

Repaying this huge pile of debt will require either reduced spending or some kind of debt liquidation where we restructure everything. Those are the only options, and both will have a profound effect on our lives and portfolios.

Within the next 5–10 years, we will face the end of a debt super-cycle that has been developing since the late 1930s. And when that day arrives, it’s going to make the financial crisis look like a picnic.

I have little faith in Washington to fix this mess. However, individually we still have the opportunity to secure the future for our children… but only if we start making plans to protect our financial futures today.

A loss of up to 3.4 million US jobs by 2025

A 2017 study from MIT showed how disruptive the rise of automation and technology has been and will continue to be to the US workforce.

The study, which looked at the impact of just industrial robots on jobs from 1993 to 2007 found that every new robot replaced around 5.6 workers. And that every additional robot per 1,000 workers reduced wages by 0.5%.

The study also found that the industrial robot workforce in the US will quadruple by 2025. That translates to a loss of up to 3.4 million jobs by 2025, alongside depressed wage growth of up to 2.6%.

But it’s no longer just factory workers being replaced. A widely-cited study from the University of Oxford found that 47% of US jobs could be automated over the next 20 years.

These massive employment changes are nothing that we haven’t seen before. 80% of Americans toiled on farms in 1800. Today that number is less than 2%.

But that change played out over more than ten full generations. The upcoming changes are going to happen in less than one generation.

That’s not much time for adjustment, especially for a country like the United States where 69% of families have less than $1,000 in savings. It’s certainly not enough to deal with the loss of your job.

I believe, these are the three overarching trends that will define the Age of Transformation. Before I tell you how we are going to prepare for this tumultuous period, I want to briefly touch on two other serious problems that we face today.

The bull market in complacency

will end badly

In the past few months, many successful money managers including Ken Griffin of Citadel and Seth Klarman of Baupost Group have returned money back to their clients.

In the case of famed value investor Klarman, Bloomberg reported that it was “because the hedge fund doesn’t see enough opportunities in the market.”

Other prominent managers such as Ray Dalio of Bridgewater, DoubleLine Capital’s Jeffrey Gundlach, and PIMCO have written letters to clients saying that now is the time to cut risk.

I believe, the caution displayed by these top money managers is all related to what I call the bull market in complacency.

Here are some of the most reckless trends in the markets today. I won’t go into detail—you know them well:

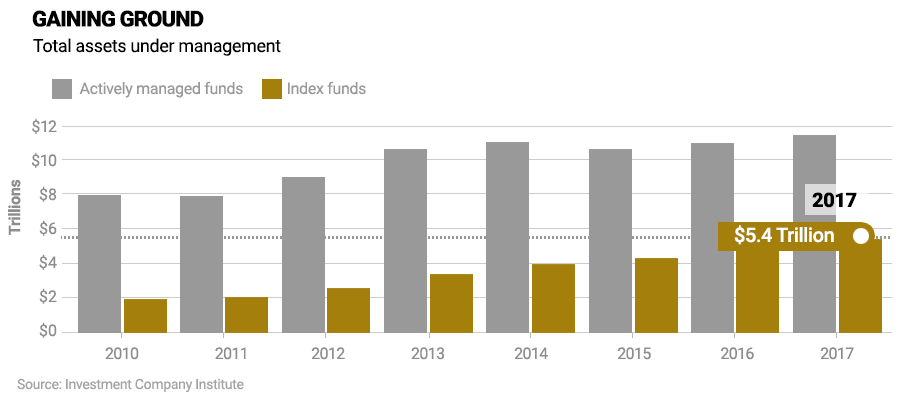

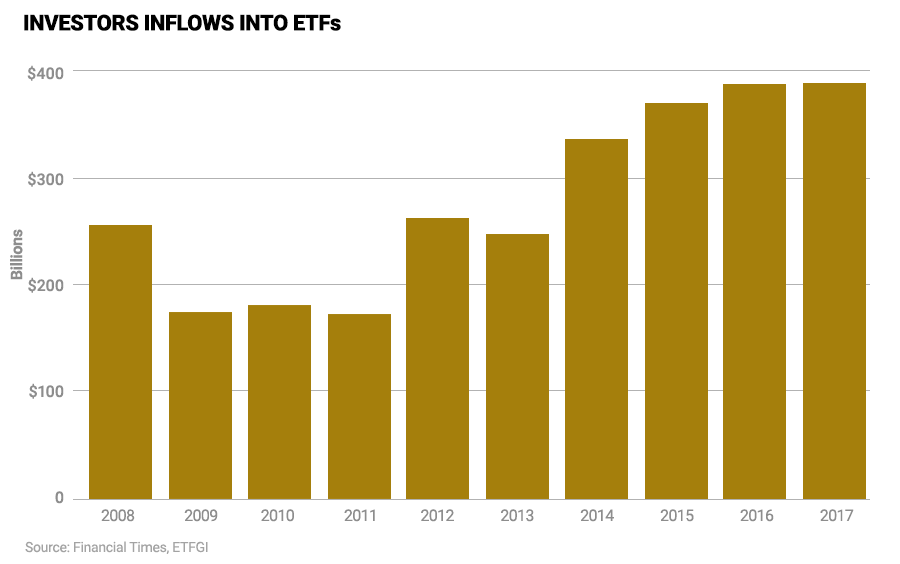

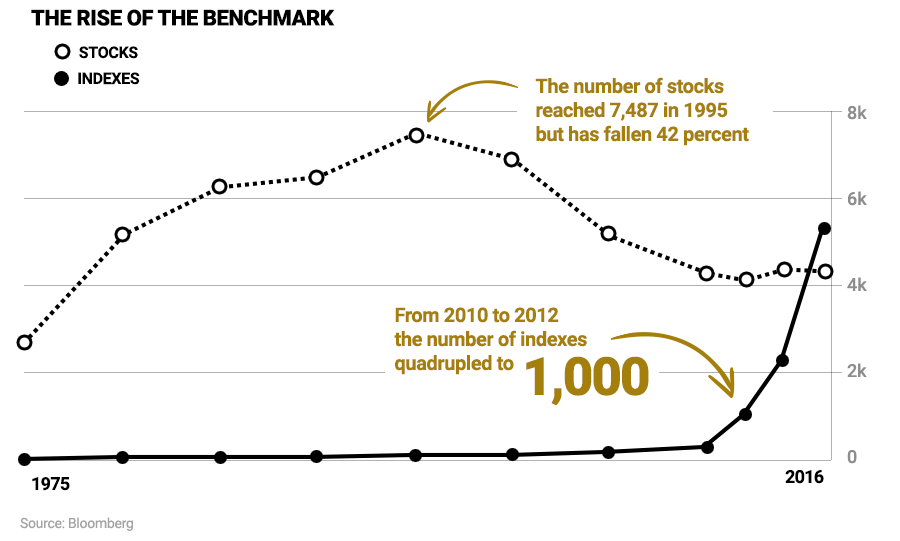

- Investors blindly piling into passive index funds without thorough due diligence

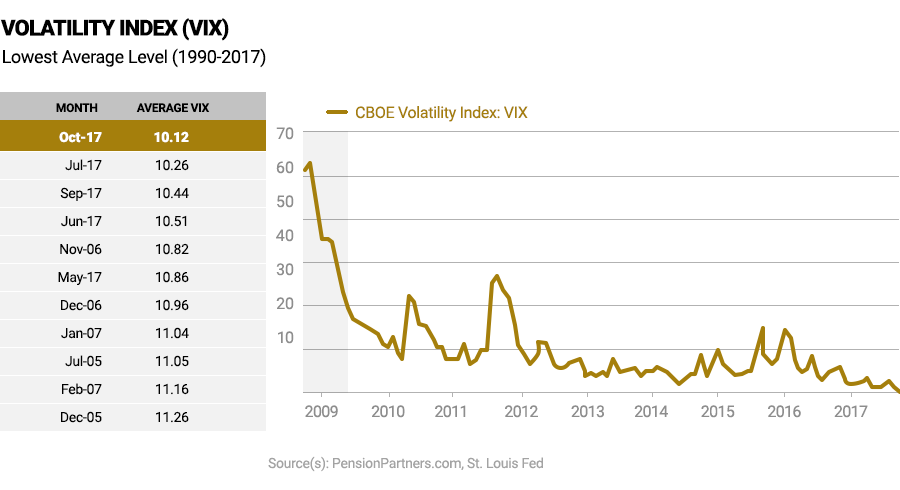

- The continued all-time lows in equity volatility and record shorting of the CBOE Volatility Index (VIX), sometimes referred to as the fear index or the fear gauge

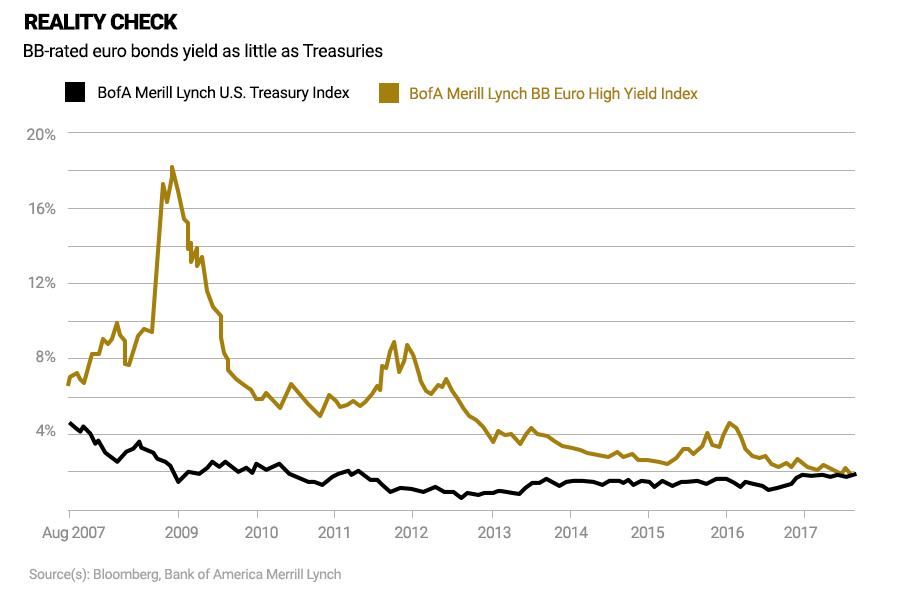

- And, the bubble in high-yield credit and corporate bonds

These heedless actions by investors are happening 8 ½ years into a bull market, when asset valuations are at all-time highs and prospective returns are at all-time lows.

When investor confidence finally turns, there’s going to be a lot of forced selling into markets where there are no buyers… which will further exacerbate the decline.

Unfortunately, whether you participated in the madness or not, the unwind will affect all of our portfolios. That’s why having a plan in place to deal with the fallout is essential.

Fed tightening cycles usually end in recession, and that’s very bad for equities

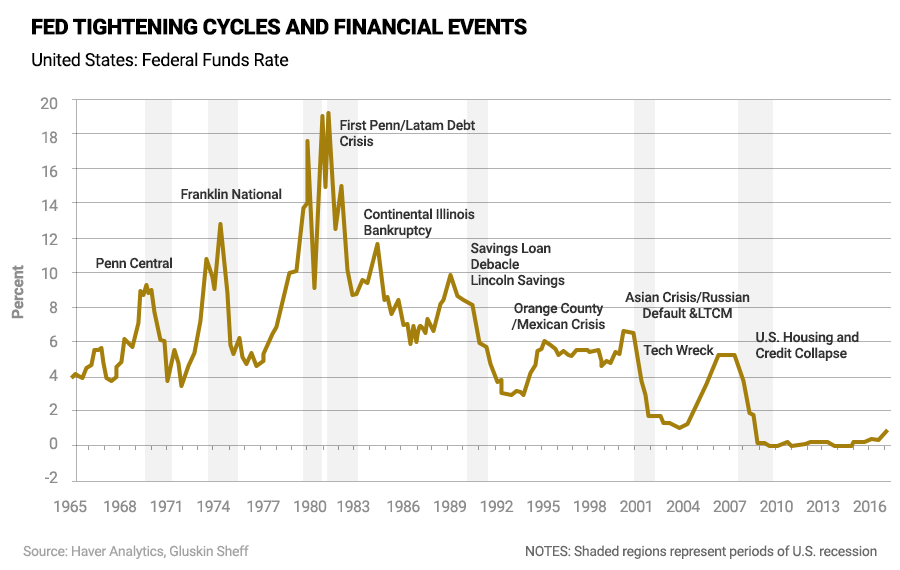

History shows that when the Fed tightens, a financial “event” usually follows. This chart from my good friend and chief economist at Gluskin Sheff, David Rosenberg shows the fallout from every Fed tightening cycle for the last five decades.

Furthermore, Fed tightening has almost always ended in recession: 17 of the 18 recessions since 1915 were preceded by monetary tightening.

And history tells us when recessions occur, bad things happen to stock markets. Since 1980, the average market drawdown in recession has been 37%.

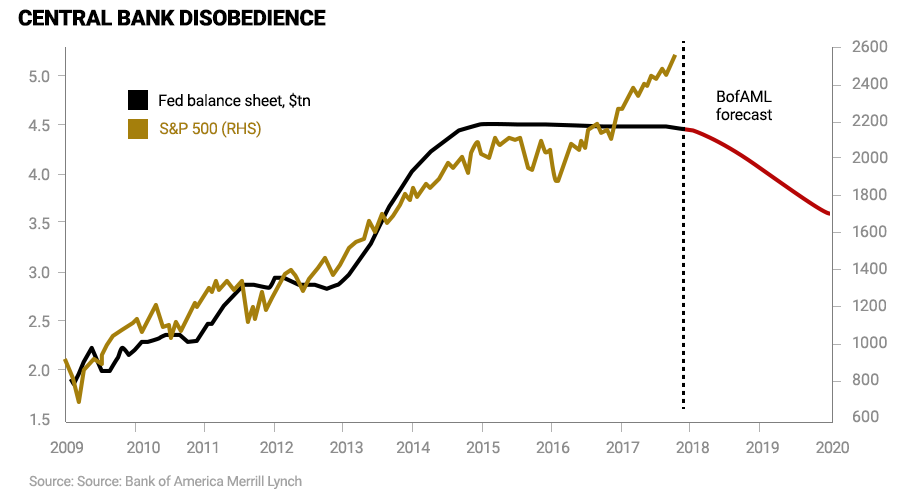

With the Fed now appearing to be on a rate-hiking path—plus the reduction of its $4.4 trillion balance sheet—this bull market’s days may be numbered. I believe this unprecedented “great unwind” may be the trigger point for the next bear market. Here’s why.

It’s clear that artificially low interest rates and the massive expansion of the Fed’s balance sheet over the past nine years have inflated asset prices. Look at this chart from Bank of America Merrill Lynch.

So, if easing was good for stocks, then to some degree the opposite must be true.

Given the exuberance in the markets over the past 12 months (the S&P 500 is up every month since October 2016), when the market turns, it will do so with a vengeance.

That’s why I believe you must put a plan in place, before the disruption unfolds.

As you can see, we face a multitude of risks to our financial futures today. Now that you understand why we need to prepare for the coming turmoil, I want to show you how.

How to Prepare for the Age of Transformation

I promised at the start of this letter that I would show you how to prepare for the Age of Transformation—thanks for sticking with me.

I’m preparing for the coming disruption by connecting with people who have the experience and skills needed to survive and prosper in exactly the kind of difficult environment were headed into.

Having access to analysis from individuals who dedicate their professional lives to seeking solutions helps me stay ahead of the changing market environment.

I want you to be able to prepare exactly as I am for the approaching disruption. That’s why I want you to become a Mauldin VIP and access the combined expertise of my entire Mauldin Economics team.

My partners and I have spent a lot of time building a team you want in the trenches with you during the Age of Transformation. Taken as a whole, the team is a key reason I know we can survive and prosper during the coming turmoil.

Their combined outlooks, their years of experience investing in every type of market, their ability to adjust to changing market circumstances and lay out a roadmap for a successful future—tell me that they’re the team to guide us through the Age of Transformation.

Mauldin Economics: Your Guide to the Age of Transformation

Our mission at Mauldin Economics is simple—to help you chart your investment course and be among the first to know about looming risks and new opportunities. We do that by getting the most relevant research into your hands exactly when you need it.

I often tell my business partners that our readers are great market guides–that’s certainly true in the case of our letters. Every one of our premium services was created as a solution to a major problem facing readers.

It has taken five years of careful planning and development to create this stable of premium services… and for good reason.

The specific objective of each letter was personally crafted by my partners and me, and the individual chosen to run each service was hand-picked. Then, we had to make sure each letter complemented the others.

The result is that we now have a service—Mauldin VIP—where the perspective and approach of each premium letter enhances the other.

That’s why to make full use of the service we offer at Mauldin Economics, to act on our insights–in real time–having access to the full stable of premium services is essential.

To show you how to take full advantage of what we do, let me tell you why I created each premium service, and how each one can offer you solutions to the problems we face today.

Earning Yield in a Low-Yield World

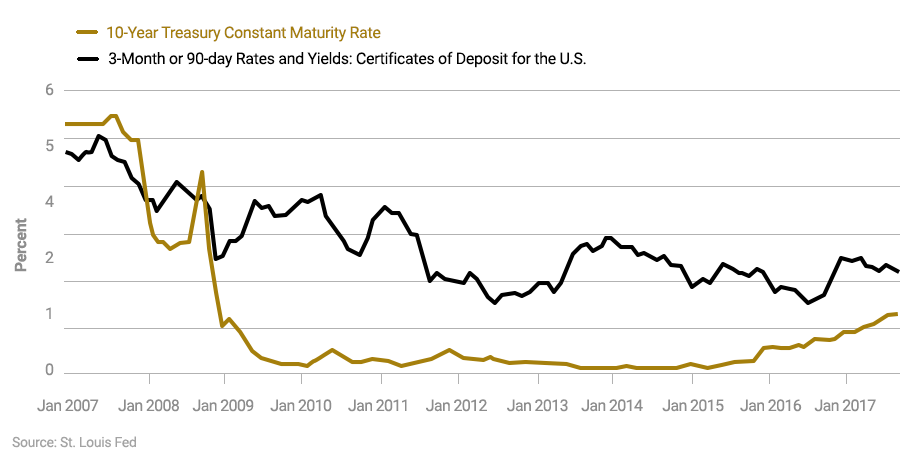

My quest to help investors accelerated in 2012, when I became concerned about the problems a low-interest rate environment would pose for savers and retirees.

Before the financial crisis, earning yield was simple. You could invest your money in short-term CDs or 10-year Treasuries and safely earn 4%–5% a year. It was a “set it and forget it” strategy. And it worked.

But when the crisis hit, the Fed took a hatchet to interest rates… and to those opportunities.

I knew that if we didn’t develop a plan, many of you would suffer the consequences.

Mauldin Economics' first newsletter, Yield Shark, was created as a solution to this problem. Its mandate is to help readers find yield in this low interest rate world.

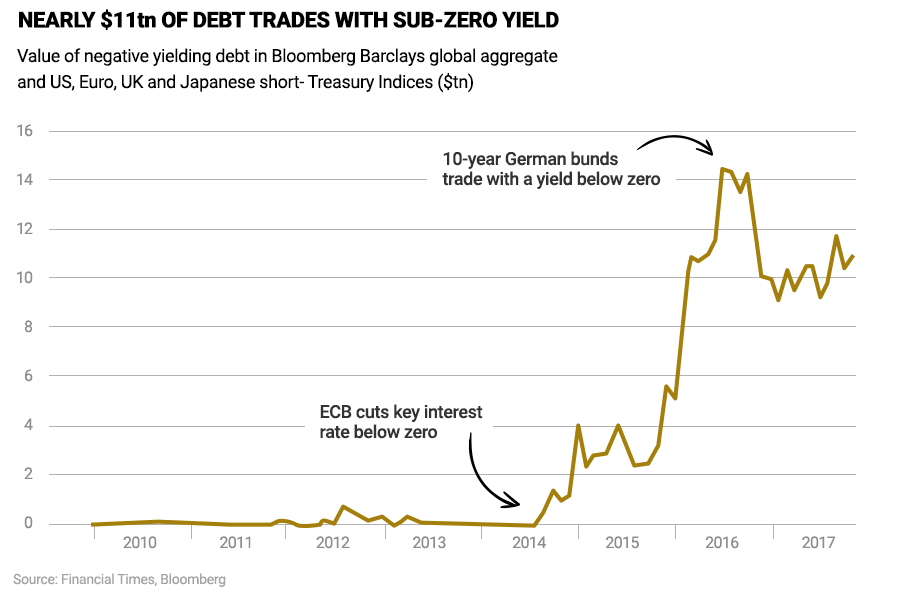

Don’t be fooled by the recent miniscule rise in rates: when the average dividend yield on the S&P 500 is below 2% and there’s $11 trillion in negative yield debt in the world, we are still in a low rate environment.

Yield Shark is written by Patrick Watson. Patrick has over three decades of experience in the investment industry and is the senior economic analyst at Mauldin Economics.

Patrick Watson

Patrick WatsonIn Yield Shark, Patrick helps readers find yield through carefully chosen, income-generating ETFs, funds, and stocks.

Although he hunts down high-income opportunities, Patrick knows yield investors always put “safety-first.” That’s why Yield Shark’s exposure is spread across asset classes and sectors, to help reduce the downside if something goes awry.

All of the Mauldin Economics letters were created for similar reasons—as solutions to the urgent problems readers were facing. Take Street Freak and Jared Dillian for example.

Be a Contrarian, or You Will Be a Victim

A few years back, I saw markets becoming more and more unanimous in their beliefs.

Investors were all moving in the same direction, making the same trades—piling into the top few ETFs and chasing consensus picks.

The fact that everyone was thinking the same thing further reinforced the market’s dogma, which led to even more “groupthink.”

As such, I knew readers needed insights from someone who approached investing in an independent way—a contrarian thinker—but not just for the sake of being a contrarian.

To quote Howard Marks, “The key to outperformance is to think different and better. Different is not sufficient, it has to be different and better.”

My readers needed access to someone with deep market experience, who also thought differently.

As fate would have it, Jared Dillian was introduced to us around that time. As you may know, Jared is the former head of ETF-trading at Lehman Brothers.

Jared worked on the floor of the Pacific Options Exchange in San Francisco at the height of the dot-com bubble, so he experienced peak groupthink first-hand.

Jared Dillian

Jared DillianFrom 2001 to 2008, he worked at Lehman Brothers—first as an index arbitrage trader and then, as I mentioned, as the head of the ETF trading desk.

Since leaving Wall Street, Jared has successfully evolved from trader to investor. Today, he leverages the lessons he learned from his years in the belly of financial markets to bring you Street Freak.

Street Freak is a unique research service that targets the best risk-adjusted returns for its readers. Jared’s unique ability to pick winners from the “Most Hated” pile of stocks, makes him the man to steer your portfolio away from consensus thinking.

And being a contrarian is a lot harder than it sounds. It means doing the opposite of the crowd. It means having the stomach and stamina to buy assets or investments that are unloved, misunderstood, and trading at bargain prices.

While difficult to achieve, out-of-consensus thinking has reaped rewards in the past.

This excellent chart from my good friend and CEO of Gavekal, Louis Gave, shows the consensus is often very wrong.

Jared is a keen student of investor sentiment, always on the lookout for instances where everyone is thinking alike and then generating trading ideas from his findings.

If you value the contrarian viewpoint and want access to a high-performing portfolio targeting the best risk-adjusted returns, then Street Freak is a perfect fit for you.

Access to Insights from the World’s Top Money Managers

This idea of giving readers access to insights from successful investors and independent thinkers was also the reasoning behind Over My Shoulder.

After the financial crisis, people were left feeling betrayed by the mainstream financial media, which largely failed to warn them about what was going to happen.

Little has changed since then: financial news has continued down the road of attention-seeking sound bites that offer little value.

This has led to a situation where today, 65% of Americans say the mainstream media is full of fake news—a sentiment that is held by a majority of voters across the ideological spectrum.

I became sick of this and didn’t want my readers to have to rely on biased media sources any longer. I wanted them to have access to the mountains of independent research that arrives at my office every day.

That’s how Over My Shoulder was born.

John Mauldin

John MauldinOver My Shoulder gives you the opportunity to read along with me as I dig behind and beyond the headlines. You can view the same exclusive reports and pieces of analysis that inform my own research, in real time.

When I receive intelligent, must-read analysis, I’ll send it directly to you.

In the last month alone, I’ve sent my readers exclusive research from top money managers like Peter Boockvar, Michael Lewitt, Doug Kass, Charles Gave, JPMorgan's Marko Kolanovic… plus many more.

Much of this research is accessible only by having a six-figure account with these professionals, or paying tens of thousands of dollars in fees.

Downside Protection for Your Portfolio

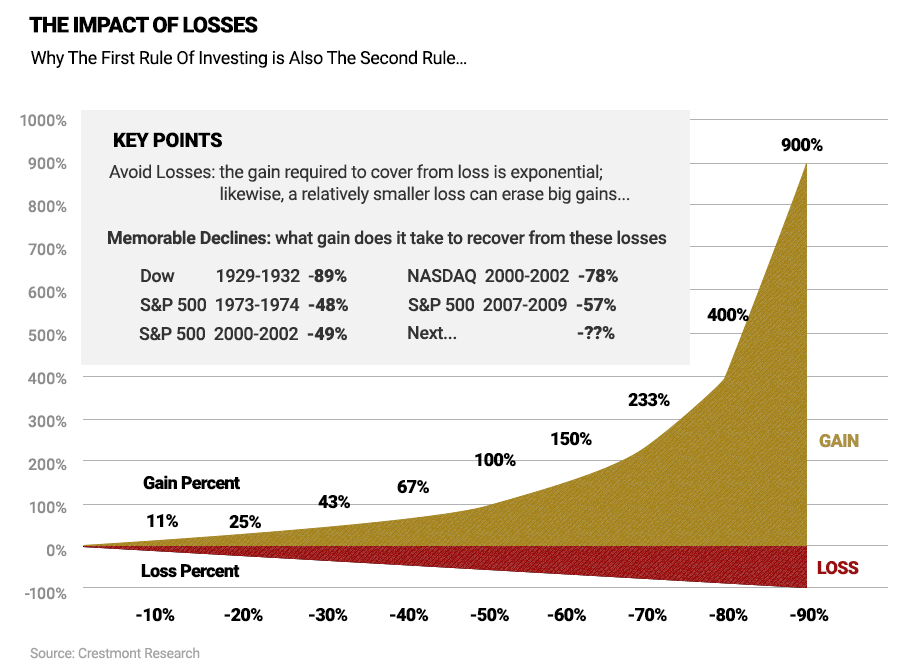

Speaking of the world’s top money managers, I’ve noticed they all have one facet of their investment discipline in common: they place great importance on avoiding losses. And for good reason. Recovering losses is a steep uphill battle.

As this chart from my friends at Crestmont Research shows, a 50% loss requires a 100% gain just to return to even.

Unfortunately, most investors don’t understand this critical point and don’t take the necessary steps to protect their portfolio from a downturn. I’m speaking from experience.

During the financial crisis, I received countless emails from distressed readers who saw 30– 40% of their portfolios wiped out and were desperately seeking advice on what to do.

Those stories of readers watching their dream retirements and their children’s college funds destroyed were the impetus for Rational Bear, our premium downside service.

Kevin Brekke

Kevin BrekkeIf there’s only one point you take away from this letter, let it be the following: You cannot prepare for the coming disruption without downside protection for your portfolio. It’s the underpinning for a successful plan to deal with the tumultuous road we are headed down.

In Rational Bear, Mauldin Economics managing editor, Kevin Brekke, focuses on helping readers protect their portfolio from a downturn in the markets.

Kevin also looks for special situations in today’s markets—situations like poorly run companies and troubled market sectors facing near-term headwinds.

Investing in the Future of Humanity

Most of our premium services at Mauldin Economics were created as solutions to big problems we face today.

But in the case of the next letter, it was to take advantage of one of the biggest opportunities in the history of mankind—the field of bioscience and life extension.

If you read me, you know that I am the most bullish man on earth when it comes to our future. In large part, that has to do with the developments in the biotech sector, which will help us live longer, healthier, and more productive lives.

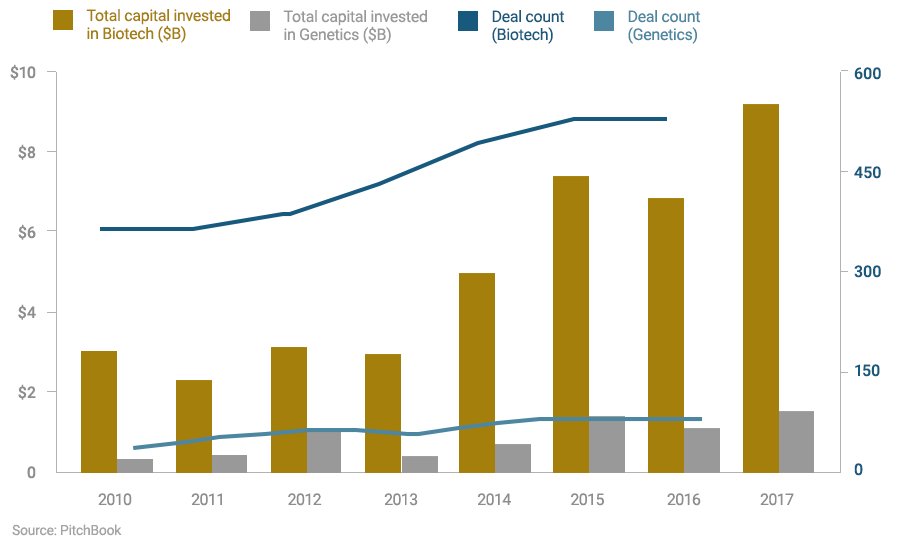

I believe over the next few decades, biotech will transform the world, as much if not more than technology has over the past 40 years.

Just like in the early 1990s when venture capital started flowing into tech, the same is happening in biotech today.

Whenever I need an update on the latest biotech breakthroughs, I turn to my good friend Patrick Cox for his expert opinion.

Patrick has lived deep inside the world of technology breakthroughs for the past 30 years, and if he doesn’t know about something in this area, it’s probably not worth knowing about.

Patrick Cox

Patrick CoxSo, when Patrick said he wanted to write for Mauldin Economics a few years back, I jumped on it. Patrick’s advisory, Transformational Technology Alert, focuses on the small-cap biotech companies that could revolutionize modern medicine.

You might not share my level of passion for biotech, but I guarantee you will be fascinated and educated by what you read in Transformational Technology Alert.

With Patrick as your guide, you’ll have a chance to find the superstar companies turning health care on its head.

The Power of Macro Insights for Your Portfolio

Since we started Mauldin Economics, I’ve received emails from readers urging me to write a newsletter that will put my macro insights to practical use.

And I’ve always had to reply with the same message: “Unfortunately, as a Registered Investment Advisor and Broker/Dealer, I’m prohibited from publicly talking about or recommending any kind of investment in a publication.”

In 2016, I finally found a solution—it’s called Patrick Watson and his premium letter Macro Growth & Income Alert.

I’ve worked with Patrick since the 1980s, and every week he helps me with research for Thoughts from The Frontline. Nobody knows my thought process better than Patrick—he’s the guy that can take my macro ideas and make them investable.

Now, the term “macro investing” gets thrown around a lot, but many investors don’t realize the power of being able to spot the right macro trends.

As an investor, you can certainly identify a great company, selling for a great price, and run by great people. But if that company is on the wrong side of a big trend, it likely won’t do you any good.

Remember, there was a “best” movie rental company and VCR maker at one time, and you know where it is today. You want to be the equivalent of an early investor in Amazon, not the one left holding Kodak.

This all speaks to the power of getting the macro picture right.

While getting the macro picture right is essential, that doesn’t mean that bottom-up, fundamental analysis isn’t important.

Robert Ross & Patrick Watson

Robert Ross & Patrick WatsonLegendary short-seller Russell Clark spoke to this point in a recent interview with RealVision TV: “What I've found with the macro guys is where they go wrong is they don't match up the micro with the macro. That's when you get the really powerful moves.”

We agree with Russell, and that’s one of the reasons we built Macro Growth & Income Alert the way we did.

The letter blends the trend-spotting macro perspective of Patrick with quantitative rigor of our senior analyst Robert Ross to take the kind of macroeconomic insights you read in Thoughts from the Frontline and convert them into a portfolio.

A New Solution for Intelligent ETF Investing

Our newest premium service at Mauldin Economics was created as a solution to the explosion in passive investing over the past few years.

I believe passive investment strategies will come under severe pressure in the coming years, and the investors who have indiscriminately piled into ETFs will suffer big losses.

For example, approximately 30% of the companies listed in the Russell 2000 have less than zero earnings. That means if you own an index fund for the Russell, not only are you getting the stocks of well-run companies, you’re also getting the ones that have no earnings.

I don’t think that’s a recipe for success.

At the same time, I believe ETFs also present one of the most exciting, profitable opportunities available to investors today.

ETFs have changed investing forever. It’s now a global, $4.4 trillion industry–there are now more ETFs than individual stocks!

I believe we should learn to use ETFs to our advantage—just like many of the world’s most successful money managers have.

If you look through the 13-D SEC filings for the likes of Ray Dalio’s Bridgewater Associates, John Paulson’s Paulson & Co, and Stan Druckenmiller’s Duquesne Capital, you will find ETFs often make up many of their top holdings.

Jared Dillian

Jared DillianGiven the dangers and opportunities ETFs present, I knew we had to develop a service which focused on investing in carefully chosen ETFs, with a long-term view.

And I knew the right man to take the helm.

ETF 20/20, Jared Dillian’s new publication, focuses exclusively on helping you become a successful long-term ETF investor.

Given Jared’s mix of Wall Street ETF experience (billions of dollars passed through his hands during his time at Lehmann Brothers) and Main Street ETF analysis, he’s uniquely qualified to run an ETF publication for individual investors.

Along with gaining access to our seven premium services, you will also receive several special reports when you become a Mauldin VIP. These reports include:

Protect Your Estate Now: A Concise Guide to Family Wealth Preservation (a $149 value). Protect Your Estate Now is an easy to read, full-spectrum report on estate planning. This report cuts through the complexity of estate planning and arms you with the knowledge to lower your taxes and fortify your estate today.

Portfolio Risk Insurance: How to Stay Invested and Arm Yourself Against Market Uncertainty (a $49 value). In this 27-page special report, you’ll learn why buying portfolio insurance is critical for your financial future. The report also shows you how to calculate your insurance needs and provides a step-by-step guide to making the trades.

Get Defensive: The 4 Best Stocks to Get Defensive in a Crazy Market (a $49 value). In this report, you’ll learn about sectors and stocks that have proven they can withstand a serious market correction. You’ll also learn about the sectors that are most at risk in a downturn.

The Biggest Risks to Your Portfolio and Best Opportunities in Today’s Market (a $49 value). This two-part report draws on the insights from speakers at the 2017 Strategic Investment Conference to draft the blueprint on the wide-array of dangers facing investors, and details emerging opportunities you can get positioned in.

Start Preparing for the Age of Transformation Today

The seven premium services that are part of a Mauldin Economics VIP membership are our solution for the unpredictable investment environment that lies ahead.

My team’s combined outlooks, their ability to adjust to changing market circumstances, and capacity to continually find opportunities in even the toughest of markets will give you the best possible chance to prepare for, and take advantage of, the opportunities the Age of Transformation will present.

Now, if you need another good reason for subscribing, it’s a simple question of doing the math.

If you add up what it would cost you to subscribe to each of these services for one year, the total amount comes to $6,741—and I believe they’re worth every penny.

A one-year VIP membership, on the other hand, will get you the same services for just $2,475—which adds up to a savings of $4,266 or 63%.

Become a Mauldin Economics VIP NowBefore I sign off, let me share a few important details of your VIP membership:

- If you already subscribe to any Mauldin Economics publications, you’ll pay even less—we will credit the remaining months of your subscriptions to your VIP membership fee.

- Your VIP membership is completely risk free for 30 days. You can take that time to settle in—and if you decide that a VIP membership is not for you, simply cancel within those 30 days for a full refund, or you can request to go back to your previous subscriptions, and we’ll be happy to help you. After 30 days, you can still cancel at any time, and we will give you a pro-rated refund on the remaining term of your Mauldin VIP subscription.

- As always, the window for becoming a VIP member is narrow. We will close this offer on December 13 and won’t reopen it for at least six months.

And now, that really is it for today. I hope you start preparing today, so we can benefit from the Age of Transformation together.

Your looking forward to an exciting future together analyst,

John Mauldin

Chairman, Mauldin Economics

© 2019 Mauldin Economics.

© 2019 Mauldin Economics.All rights reserved.