View:

April 25, 2024

April 24, 2024

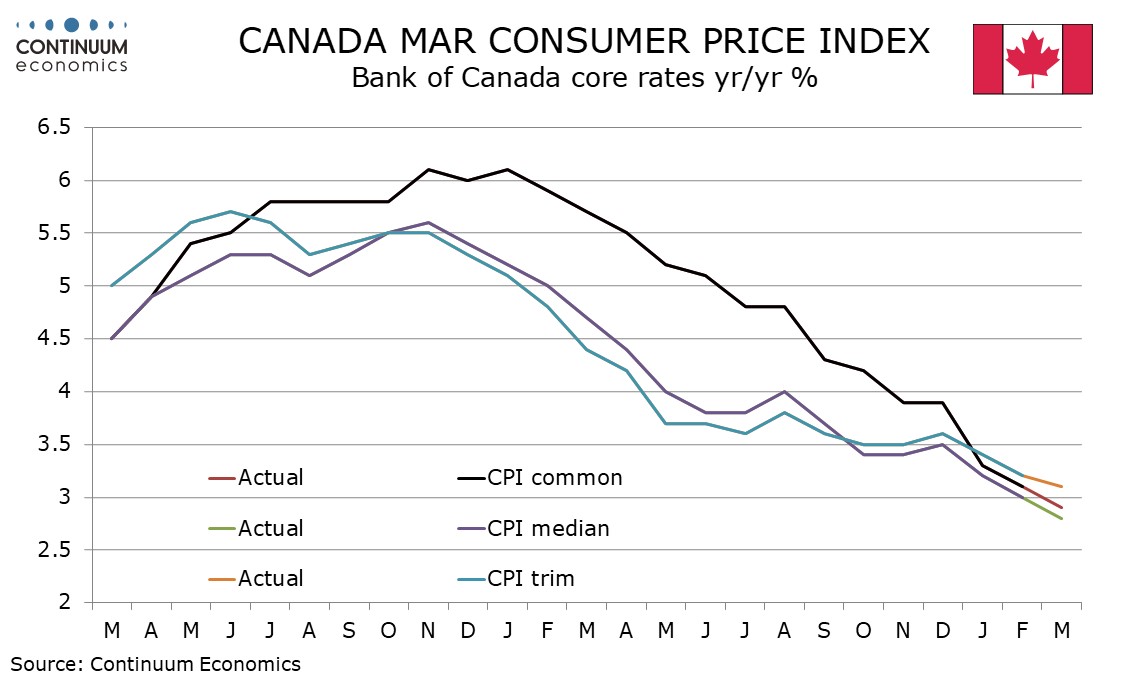

Bank of Canada Minutes Look to Gradual Easing, Divided on When to Start

April 24, 2024 6:44 PM UTC

Bank of Canada minutes from the April 10 meeting confirm a greater confidence on inflation falling, though there is disagreement within the Governing Council over when policy easing will become appropriate. There was agreement that easing would probably be gradual given the risks to the outlook and

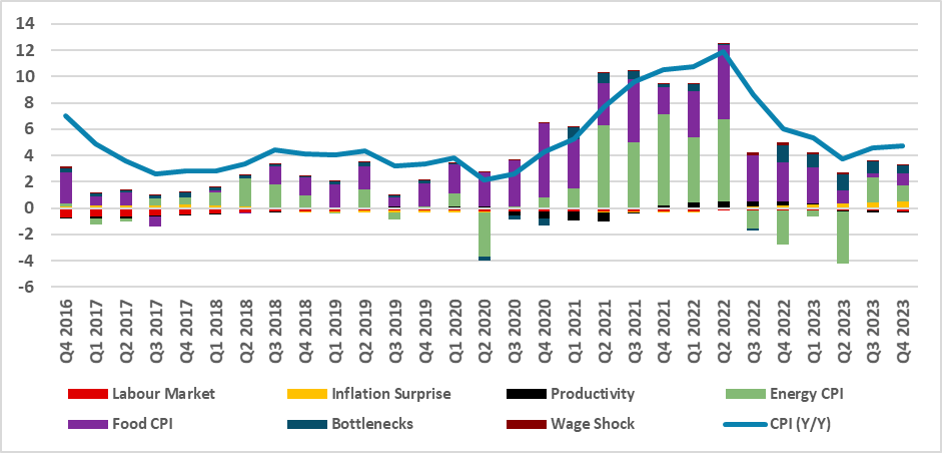

Brazil: Wage Inflation Will Likely Not Be a Big Deal

April 24, 2024 3:19 PM UTC

Our analysis delves into recent trends in the Brazilian labor market, focusing on CPI and wage inflation. Utilizing a model akin to Ghomi et al. (2024) and Blanchard and Bernanke (2023), we dissect recent spikes in wage inflation and CPI growth. Notably, our findings suggest that recent wage spikes

Preview: Due April 30 - Canada February GDP - Another rise, but a slower one

April 24, 2024 3:07 PM UTC

We expect Canadian GDP to increase by 0.3% in February, slightly below a 0.4% estimate that was made with January’s report, where a strong 0.6% monthly increase was seen, flattered by the end of public sector strikes. We expect preliminary indications for March to be near flat.

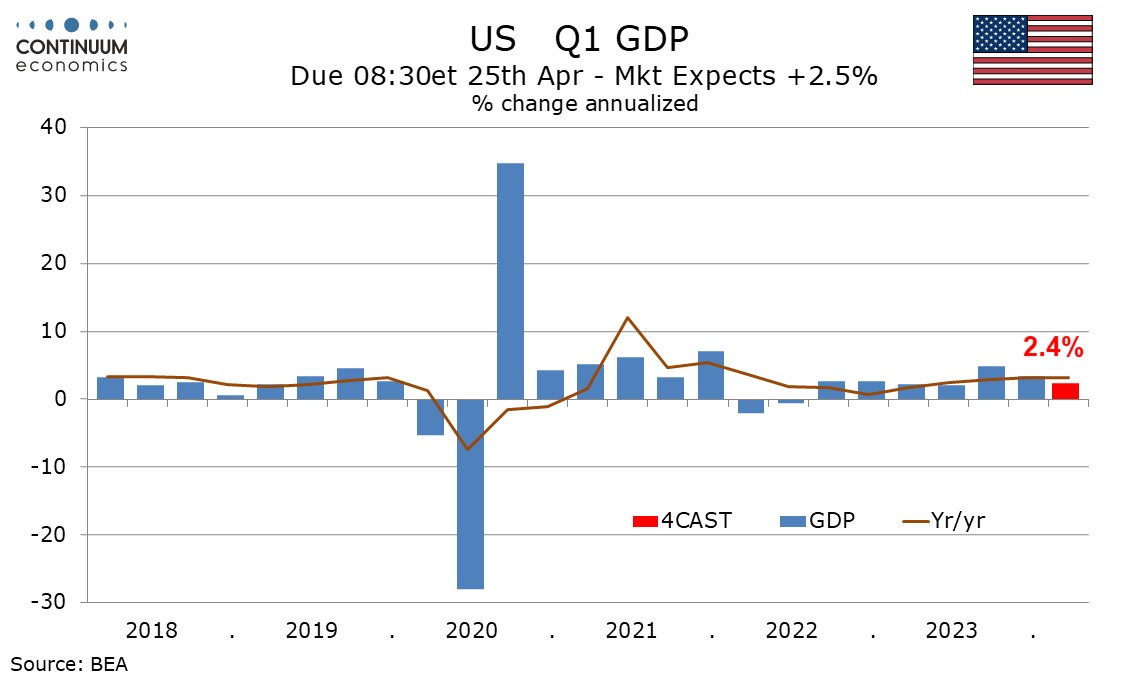

Preview: Due April 25 - U.S. Q1 GDP - Slower but Still Healthy With Stronger Core PCE Prices

April 24, 2024 1:54 PM UTC

We expect a 2.4% annualized increase in Q1 GDP, significantly slower than the second half of 2023 but slightly stronger than the first half and still a heathy pace of growth. We expect a pick up in the core PCE price index to 3.4% annualized after two straight quarters at 2.0%.

Preview: Due April 25 - U.S. March Advance Goods Trade Balance - Exports, imports and deficit to increase

April 24, 2024 1:14 PM UTC

We expect March’s advance goods trade deficit to rise to $91.2bn from $90.3bn, reaching an 11-month high. We expect exports and imports to both increase by 1.0%, though imports would then see the larger increase in USD terms.

U.S. March Durable Goods Orders - Underlying trend still near flat

April 24, 2024 12:51 PM UTC

March durable goods orders are in line with expectations with a 2.6% increase overall, 0.2% ex transport, keeping trend near flat, with non-defense capital ex aircraft seeing similarly modest 0.2% increases in both orders and shipments.

China: Surging Government Debt and Does It Matter?

April 24, 2024 9:30 AM UTC

Total non-financial sector debt, plus the IMF estimates of government debt/GDP, do seem to matter for the action of China authorities, as fiscal policy stimulus is targeted rather aggressive as in 2009 or 2015. The overall debt picture also matters for the growth outlook, as the excess debt/GDP le

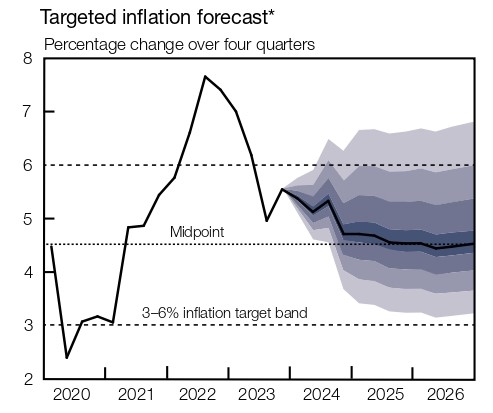

Sticky Inflation Causes Concerns over the Horizon

April 24, 2024 9:26 AM UTC

Bottom line: According to the Monetary Policy Review Report by the South African Reserve Bank (SARB) on April 23, the risk of higher inflation still remains and inflation returning to the midpoint of the target band is only expected in the last quarter of 2025. SARB highlighted in its report that ma